Waiting for a refund after an Apple Pay purchase can be frustrating. You see the charge on your account, but your money has yet to return. How long should you expect to wait? While refund times vary, most Apple Pay refunds only take 1-2 days to process. However, some can take up to 10 business days. Factors like your bank and type of refund can impact the timeline. In this article, we’ll walk through what controls refund timing, when to contact your bank and tips for speeding up the process. You can better understand and manage Apple Pay refunds with the correct information.

Executive Summary

Apple Pay refunds typically take 1-2 business days to process, though some can take up to 10 business days, depending on your bank. The refund first goes back to your Apple Pay Cash card. From there, it’s sent to your bank and deposited in your account. If you are still waiting for the refund after two weeks, contact your bank to investigate. To speed up Apple Pay refunds, use a credit card instead of a debit card, as credit transactions can be processed faster. Also, confirm your bank account and contact info is up to date. With patience and checking your funds, your Apple Pay refund should come through shortly.

Factors Affecting Apple Pay Refund Time

How Long Does it Take? Understanding What Impacts Apple Pay Refunds

Waiting for a refund after an Apple Pay purchase can be frustrating. You see the charge disappear from your account, but the funds can reappear. So, what determines how quickly you’ll get your money back? Several key factors can influence Apple Pay refund speed.

Payment Method

The first significant factor is whether you paid with a credit or debit card. Credit card refunds generally process faster, usually 1-3 business days. That’s because credit refunds are handled directly between the merchant and card issuer. Debit card refunds take approximately 5-10 days longer because the money has to go back into your bank account.

Refund Type

Another consideration is the type of refund – whether it’s back to your credit card, bank account, store credit, phone bill, etc. A credit back to your card will be the quickest. Refunds to bank accounts or other payment methods require additional transit time. Store credit is instant, but you lose the cash value.

Bank Processing

Your bank’s policies also impact Apple Pay refund time. Some banks place holds on incoming transfers or have rigid processing schedules, which can delay the availability of funds by several days. Large banks tend to be slower, while credit unions and online banks may be faster. Check bank refund times before paying with Apple Pay.

Card Issuer

For credit card refunds, the card issuer’s procedures make a difference. Issuers like American Express and Discover tend to be more efficient, depositing refunds into accounts rapidly. Meanwhile, depending on the bank, Visa or Mastercard refunds may take longer. Research your card’s typical refund speed.

Transaction Size

More significant transaction amounts generally require more processing time. This is due to increased security and fraud checks that banks enforce. Refunds under $10 or $25 tend to be quickest, while large sums of $100+ may be held for verification and take up to 10 days.

Country/Region

Geographic factors like country and region also play a role. Refund systems and efficiency vary globally. Asia and North America see the fastest turnarounds, while Latin America and Africa are slower. Even within the US, West Coast banks tend to be quicker than East Coast ones.

Holidays/Weekends

Apple Pay refunds only move on business days, so holidays and weekends pause the progress. If a refund is issued right before a holiday, expect added delays. Schedule significant returns strategically to avoid these slow periods.

Account Verification

Double-check your personal details and account numbers to ensure verification is timely. Refund issuance may be halted for manual checks if your address or card number doesn’t match the merchant’s records. Keep your info current for faster processing.

Knowing these key factors gives you better clarity on when your Apple Pay refund should be completed based on your bank, location, and other details. Be patient, but follow up if your refund takes longer than expected.

Refund Time for Different Payment Methods

Not All Refunds Are Equal: Return Timeframes By Payment Type

When requesting a refund for an Apple Pay purchase, it’s important to understand that refund speed can vary significantly depending on your original payment method. While Apple aims to process all returns within ten business days, certain payment types inherently take longer to reimburse.

Let’s break down the estimated refund times for the main Apple Pay payment options so you know what to expect.

Apple Store Credit

If you paid using an Apple Store gift card or Apple ID funds, the refund will be credited back to your Apple Store Credit balance. This is usually the fastest option, with the refund appearing in your Apple ID wallet within 24-48 hours. You’ll receive an email confirmation when it has been processed.

Mobile Phone Billing

Purchases made through your monthly mobile phone bill can take the longest to refund. The refund must first be authorized by your wireless carrier, which can take up to 10 days. Then, it will appear as a credit on your next billing statement, which could be 30-60 days out. Contact your carrier if it’s been over two months.

Credit & Debit Cards

Refunds typically take 1-10 business days for credit or debit card purchases, depending on your bank’s processing times. Debit cards are on the lower end, given the additional step of depositing into your checking account. Expect at least five business days.

Third-Party Wallets

Refunds for Apple Pay transactions made through third-party wallets like PayPal or Venmo will first be credited back to your account balance with that provider. From there, transfer to your bank account takes an additional 2-5 days.

Bank Transfers

Refunds for purchases funded by direct bank transfer may take 3-10 business days to reflect back in your checking or savings account. Transfers originating from another bank account could add further delays.

All Other Methods

For any other type of Apple Pay payment, allow up to 30 days for the refund to process and show on your account statement or balance fully. If it’s been over a month, follow up with your financial institution.

Understanding the typical refund timeframe for your payment method takes the stress out of waiting and wondering. Be aware Apple Pay returns may exceed general e-commerce refunds due to extra transit steps. Patience and persistence pay off.

Refund Time for Apple Pay Later

Getting Your Money Back: Refunds for Apple Pay Later

Apple’s buy now, pay later service Apple Pay Later offers convenience at checkout. But what happens if you need to return an Apple Pay Later purchase? Here’s what to know about refunds when using this financing option.

Overview of the Refund Process

With Apple Pay Later, you borrow the purchase amount from Apple over six weeks with zero interest. When you request a refund, Apple will first credit your Apple Pay Later balance. This happens in the background – the payment will disappear from your upcoming installments.

Once credited, it can take 3-10 days for the actual refund to reach your bank account or card, depending on the merchant’s and your bank’s processing times. Refunds issued on weekends or holidays may also take longer.

Monitoring Refund Status

Check your Apple Pay Later balance and payment schedule in the Wallet app to track your status. The refund will show as a credit. You can also contact the merchant directly to verify they processed the return. If it’s been over two weeks, follow up with your bank.

Refunds Exceeding Balance

If your refund amount exceeds what you still owe on the loan, Apple will send the difference back to the original debit card used for Apple Pay Later eligibility. For example, if you borrowed $200 but are refunded $250, the extra $50 will go to your bank.

Depending on your bank’s systems, it can take up to 5 business days for this excess payment to appear in your checking account. Review your account activity to confirm the deposit.

Have Receipt Handy

To expedite refund reviews, have your Apple Pay Later receipt handy as evidence of purchase. You can access it in the Wallet app > Apple Pay Activity. The receipt contains the transaction ID needed for tracking.

Knowing what to expect for Apple Pay Later refunds takes the guesswork out of getting reimbursed. Monitor your payment schedule and accounts closely. Contact Apple or your bank if you still need to see the funds after ten days.

Refund Time for In-Store Returns

Getting Your Money Back In-Store: Apple Pay Later Return Timeframes

Did you use Apple Pay Later to fund an in-store purchase and need to return the item? Here’s what to expect for in-store refunds with this buy now, pay later service.

When you return an item paid for via Apple Pay Later at a brick-and-mortar store, the merchant will cancel the transaction on their end per the usual return policy. They will then notify Apple to cancel your remaining payment plan.

This behind-the-scenes process typically takes 3-10 business days. Once processed, the upcoming payments disappear from your Apple Pay Later schedule in the Wallet app.

Refunds After Payments Made

If you’ve already started making payments on the purchase before returning, your payments will be refunded back to the original payment method used, such as a debit card.

For example, if you paid $100 upfront and have a $50 balance when you return, you’ll be refunded $100. Refund timeframes depend on the payment method.

Have Receipt Ready

To speed up in-store return reviews, have your Apple Pay Later purchase receipt handy to provide the transaction ID. Access it in the Wallet app for a smooth return experience.

Contact Apple With Issues

If your return takes longer than ten days to process, contact Apple Pay Later support for help investigating.

Understanding what to expect for in-store returns using Apple Pay Later allows you to get reimbursed quickly. Bring your receipt and proof of purchase for a seamless refund experience.

FAQ

What is the step-by-step process for an Apple Pay refund?

When you request a refund for an Apple Pay purchase, the money will first be sent back to your Apple Pay Cash account, which is linked behind the scenes to your bank account/debit card. Once Apple Pay Cash receives the funds, they will be transferred to your bank, which will then deposit them into your checking account. If you used a credit card for the initial payment, the refund will be credited back to that card. So the full process is: Seller initiates refund > Money sent back to your Apple Pay Cash account > Funds transferred back to your bank > Bank deposits money into your bank account. This multi-step process is why it takes a few days to see the refund.

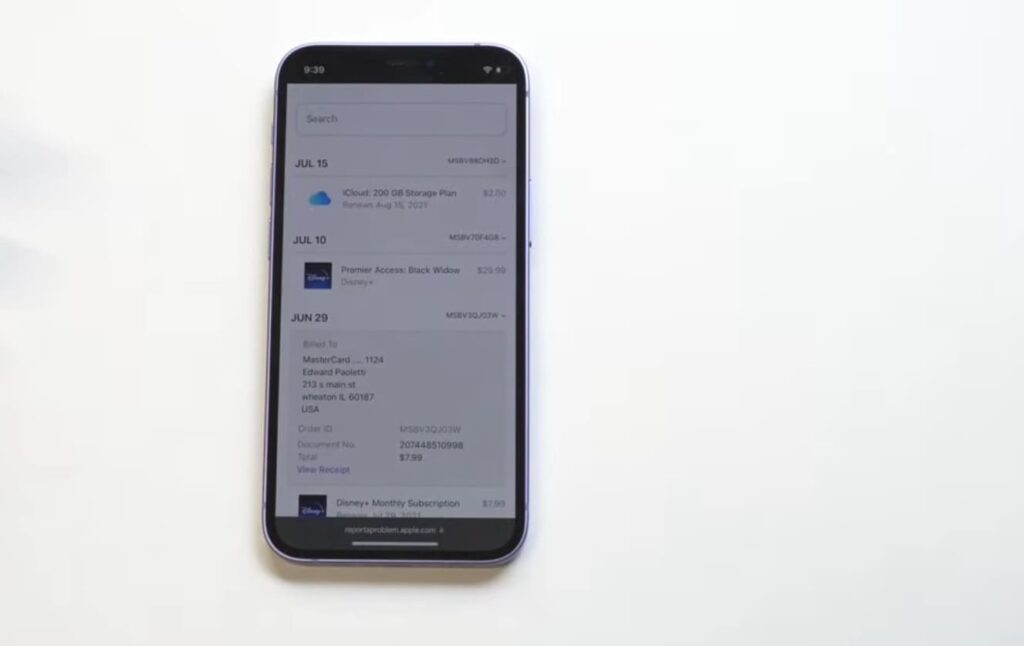

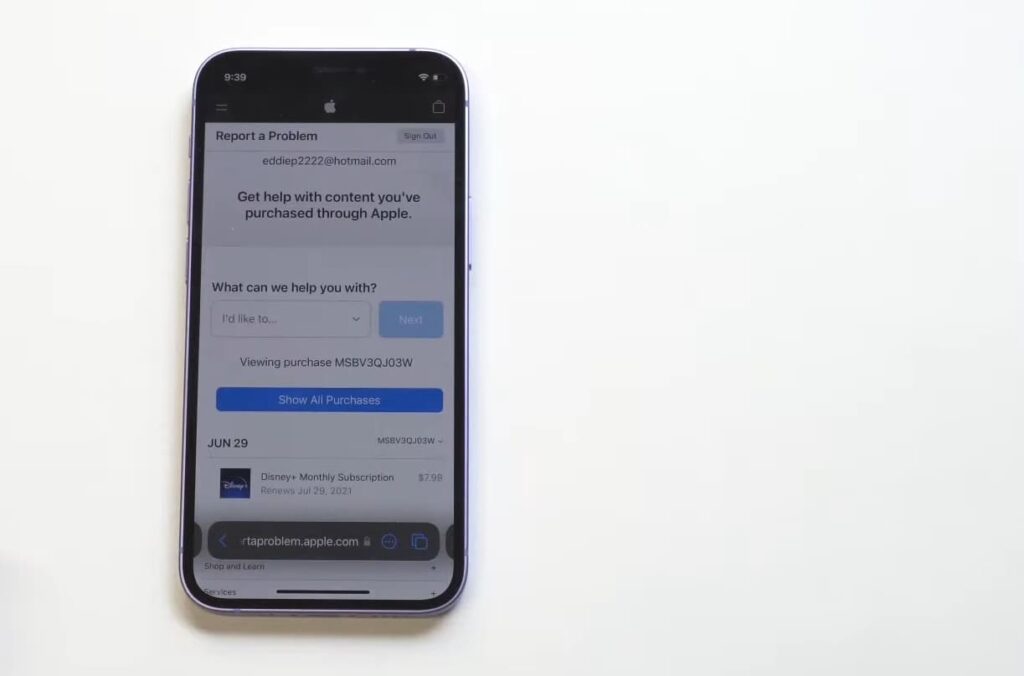

Related Video: How to Refund Apple Purchases

Final Words

While waiting for an Apple Pay refund can be annoying, most are processed quickly as long as you take the right steps. Check that your bank account and contact information are current, and contact your bank if your refund is late. Understand that debit transactions may take longer than credit. Finally, don’t fret if it takes 1-2 weeks; that’s still within the normal Apple Pay refund timeline. As long as you monitor your accounts and statements, your money should be returned soon. With these tips, you can get your Apple Pay refund smoothly and efficiently.