In recent years, “buy now, pay later” services have gained immense popularity, providing consumers with a convenient and flexible way to make purchases without immediate full payment. Among these services, Afterpay has emerged as a prominent player, offering individuals the ability to divide their payments into interest-free installments. However, a common question often arises: What happens if you fail to pay Afterpay? Can it land you in jail?

The fear of legal consequences can be daunting, and misconceptions regarding the ramifications of non-payment can spread rapidly. It is crucial to separate fact from fiction and understand the actual implications of not fulfilling your Afterpay obligations. This article aims to provide clarity on the matter and dispel any misunderstandings that may exist.

By exploring the legal framework surrounding Afterpay and similar services, we will shed light on the potential consequences individuals may face when failing to meet their payment obligations. It is essential to understand the difference between civil and criminal liabilities, as well as the role of debt collection practices in these situations.

Furthermore, we will delve into the mechanisms Afterpay employs to recover outstanding payments and the steps they typically take before escalating a situation legally. This will help you gain a comprehensive understanding of how the company handles non-payment cases and the options available to both parties involved.

To provide a balanced perspective, we will also touch upon consumer rights and protections that may be in place to safeguard individuals who find themselves unable to meet their Afterpay obligations due to unforeseen circumstances or financial hardship. Understanding these rights can empower consumers to make informed decisions and seek appropriate assistance when needed.

It is essential to note that this article does not constitute legal advice. Rather, it aims to equip readers with the necessary knowledge to navigate the complexities surrounding non-payment and Afterpay, empowering them to make informed decisions while ensuring they understand the potential repercussions.

By the end of this article, readers will have a clear understanding of the legal landscape surrounding Afterpay non-payment scenarios, enabling them to make informed choices and proactively address any financial challenges that may arise.

Remember, knowledge is power, and being well-informed is key to managing your financial responsibilities effectively. So, let us dive into the facts and dispel the myths surrounding the question: Can you go to jail for not paying Afterpay?

Can You Go to Jail for Not Paying Afterpay?

No, you cannot go to jail for not paying Afterpay. Afterpay operates as a payment facilitator and is not a creditor or lender. Non-payment of an Afterpay debt does not constitute a criminal offense. Instead, it falls under civil law, where the consequences are related to financial repercussions rather than criminal penalties.

If you fail to make payments to Afterpay, they may take actions such as sending reminders, imposing late fees, or engaging with a debt collection agency to recover the outstanding debt. However, none of these actions involve sending you to jail.

It’s important to understand the terms and conditions of your Afterpay agreement and fulfill your payment obligations. Failure to do so can have negative consequences for your credit score and financial reputation, as late payments or defaults may be reported to credit bureaus.

If you are facing financial difficulties or are unable to meet your Afterpay obligations, it is recommended to contact Afterpay directly. They may offer assistance or alternative arrangements to help you manage your payments effectively.

Remember, this response provides general information and should not be considered legal advice. If you have specific concerns or legal questions regarding your Afterpay situation, it’s best to consult with a legal professional or financial advisor.

Why Is It Important To Pay Afterpay?

Paying Afterpay is important for several reasons:

- Financial Responsibility: Fulfilling your Afterpay payment obligations demonstrates financial responsibility and integrity. It is essential to honor your commitments and fulfill your financial obligations to maintain a good reputation and credibility as a consumer.

- Credit Score and Creditworthiness: Non-payment or late payments to Afterpay can have a negative impact on your credit score. Your credit score reflects your creditworthiness and is often used by lenders, landlords, and other financial institutions to assess your ability to handle debt and make timely payments. A poor credit score can hinder your chances of obtaining future credit, loans, or favorable interest rates.

- Avoiding Additional Fees and Penalties: Afterpay may impose late fees or penalties for non-payment or missed payments. By paying on time, you can avoid these additional charges, saving yourself from unnecessary financial burdens.

- Building a Positive Financial History: Consistently making payments to Afterpay and other creditors helps build a positive financial history. Demonstrating responsible payment behavior can improve your creditworthiness and make it easier for you to secure loans, credit, or other financial opportunities in the future.

- Maintaining a Healthy Financial Standing: Paying Afterpay on time contributes to maintaining a healthy financial standing overall. It allows you to stay in control of your finances, avoid accumulating excessive debt, and reduce financial stress.

- Avoiding Debt Collection Actions: If you neglect your Afterpay payments for an extended period, the company may escalate the matter to a debt collection agency. This can lead to increased harassment, potential legal actions, and further damage to your credit history. By paying Afterpay on time, you can prevent these unpleasant and costly consequences.

Remember, it is essential to read and understand the terms and conditions of your Afterpay agreement before making a purchase. By doing so, you can ensure you are aware of your payment obligations and can budget accordingly to fulfill them. If you encounter financial difficulties, it is recommended to communicate with Afterpay to explore potential solutions or alternative arrangements that can help you manage your payments effectively.

For What Reasons Can I Go to Jail for Not Paying Afterpay?

Afterpay is not a creditor or lender, and non-payment of an Afterpay debt does not constitute a criminal offense.

Afterpay operates under civil law, where the consequences of non-payment are related to financial repercussions rather than criminal penalties. If you fail to make payments to Afterpay, they may take actions such as sending reminders, imposing late fees, or engaging with a debt collection agency to recover the outstanding debt. However, these actions are within the scope of civil law and do not involve criminal prosecution or imprisonment.

It’s important to understand the distinction between civil and criminal liabilities. Civil liabilities pertain to financial obligations and potential consequences related to debt repayment, while criminal liabilities involve offenses against the state that can result in criminal charges and potential jail time.

However, it’s worth noting that in exceptional cases where fraud or deliberate deception is involved, such as intentionally providing false information or engaging in fraudulent activities to avoid Afterpay payments, there could be legal implications. These situations would typically be evaluated on a case-by-case basis and would require evidence of criminal intent.

In summary, while there may be financial consequences for not paying Afterpay, such as late fees, credit score impact, or debt collection activities, you cannot be jailed solely for failing to make Afterpay payments.

How To Use Afterpay?

Using Afterpay is relatively straightforward. Here’s a general guide on how to use Afterpay:

- Set Up an Afterpay Account: Visit the Afterpay website or download the Afterpay mobile app from your app store. Sign up for an account by providing the required information, including your name, email address, phone number, and payment details.

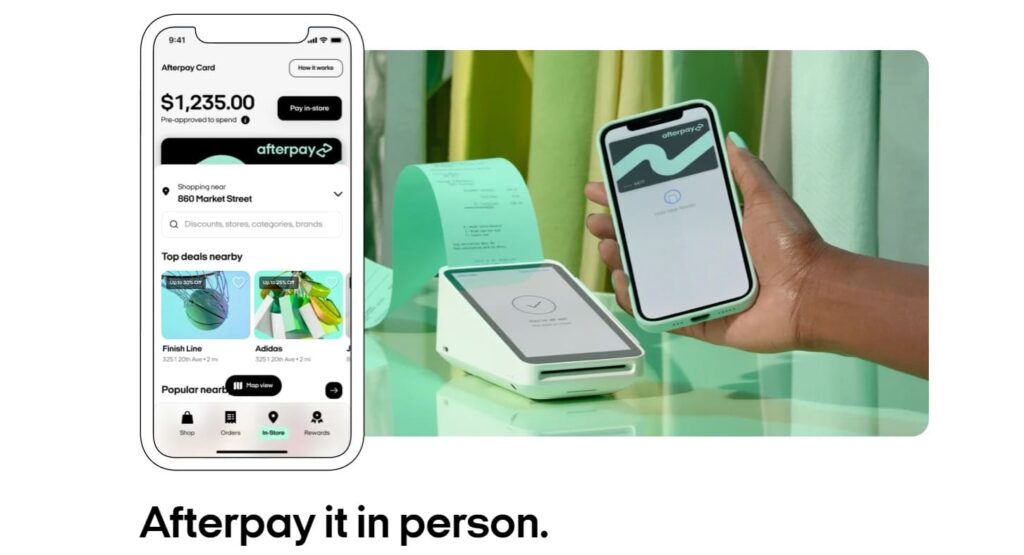

- Find a Participating Retailer: Afterpay is available at various online and physical retailers. Look for the Afterpay logo or payment option at the checkout of the retailer where you wish to make a purchase. Not all retailers offer Afterpay, so verify its availability beforehand.

- Add Items to Your Cart: Select the items you want to purchase and add them to your shopping cart.

- Proceed to Checkout: When you’re ready to complete your purchase, proceed to the checkout page.

- Choose Afterpay as the Payment Method: At the payment section, select Afterpay as your preferred payment option. If you’re using the Afterpay app, you may be redirected to the app to complete the process.

- Sign In to Your Afterpay Account: If you haven’t already signed in to your Afterpay account, you’ll be prompted to do so. Enter your login credentials to proceed.

- Verify Your Purchase: After signing in, you’ll be redirected back to the retailer’s website or app. Review your order details and confirm the purchase.

- Make the First Payment: With Afterpay, your total purchase amount will be divided into equal, interest-free installments. You’ll be required to make the first installment payment at the time of purchase. This payment is typically around 25% of the total purchase amount.

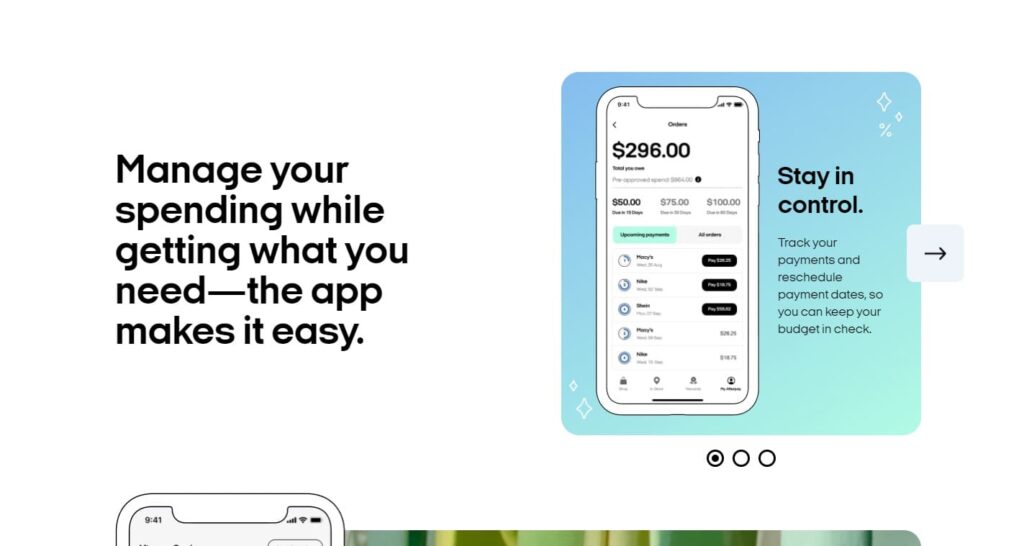

- Repayments: After the initial payment, the remaining installments will be automatically deducted from the payment method you provided to Afterpay. These payments are typically scheduled every two weeks, but you can view the exact payment dates and amounts in your Afterpay account.

- Manage Your Afterpay Account: You can log in to your Afterpay account at any time to view your payment schedule, make early repayments, or update your payment details.

It’s important to note that Afterpay’s terms and conditions may vary slightly, so it’s advisable to review the specific details provided by Afterpay during the checkout process or consult Afterpay’s official website for more information.

Remember, responsible use of Afterpay involves budgeting and ensuring that you can meet your installment payments on time to avoid late fees or potential credit score impact.

Advantages of Afterpay Payment

Paying with Afterpay offers several advantages:

- Flexibility: Afterpay provides flexibility in managing your purchases by allowing you to split the total cost into interest-free installments. This can help you budget more effectively and spread out payments over time, making larger purchases more affordable.

- Instant Approval: Afterpay offers instant approval at the point of sale, allowing you to complete your purchase without the need for a lengthy credit application or approval process. As long as you meet Afterpay’s eligibility criteria, you can start using it right away.

- Interest-Free Payments: Afterpay does not charge interest on your payments. As long as you make your payments on time, you won’t incur any additional interest charges, making it a cost-effective alternative to traditional credit options.

- Convenience: Afterpay offers a seamless and convenient shopping experience. It is available at a wide range of online and physical retailers, allowing you to use it for various types of purchases. The Afterpay app also provides an easy-to-use platform for managing your payments and tracking your purchase history.

- Improved Cash Flow: By splitting your payments into installments, Afterpay can help improve your cash flow. Rather than paying the full amount upfront, you can spread the cost over several weeks or months, giving you more financial breathing room.

- No Credit Checks: Afterpay does not perform a traditional credit check when you sign up. Approval is based on factors such as your payment history with Afterpay and your ability to make timely payments. This can be beneficial for those who have limited credit history or prefer not to undergo a credit check.

- Customer Protection: Afterpay offers customer protection through its dispute resolution process. If there are issues with your purchase or if you need to dispute a transaction, Afterpay can step in to help resolve the matter and ensure a satisfactory outcome.

It’s important to note that while Afterpay offers these advantages, responsible use is key. Ensure that you can make your installment payments on time to avoid late fees and potential credit score impact. It’s also essential to budget and only use Afterpay for purchases you can afford within your financial means.

Disadvantages of Afterpay Payment

While Afterpay offers several advantages, it’s important to consider the potential disadvantages as well:

- Risk of Overspending: Afterpay’s installment model may tempt individuals to overspend or make impulsive purchases. The ability to split payments into smaller amounts can create a false sense of affordability, potentially leading to accumulating debt if purchases are not carefully budgeted and managed.

- Late Fees and Charges: If you miss an installment payment or fail to make payments on time, Afterpay may charge late fees. These fees can add up and increase the overall cost of your purchase. It’s important to understand the payment schedule and ensure you have sufficient funds to meet your payment obligations.

- Potential Credit Score Impact: While Afterpay does not perform a traditional credit check, they may report late or missed payments to credit bureaus. If you consistently fail to meet your Afterpay payment obligations, it can have a negative impact on your credit score, potentially affecting your ability to secure future loans or credit.

- Limited Purchase Protection: Unlike credit cards or some other payment methods, Afterpay may offer limited purchase protection. If there are issues with a purchase or the product received, resolution may need to be sought directly with the retailer. Afterpay’s dispute resolution process can assist, but it may not offer the same level of protection as certain credit card chargeback options.

- Potential Impulse Buying: The convenience and ease of using Afterpay may lead to impulse buying behavior. It’s important to be mindful of your purchasing decisions and consider whether the items you’re buying are truly necessary or align with your financial goals.

- Limited Merchant Availability: While Afterpay is available at many retailers, it may not be accepted everywhere. You may encounter situations where your preferred merchant does not offer Afterpay as a payment option, limiting your ability to use the service for certain purchases.

- Accumulation of Debt: If not managed responsibly, using Afterpay can lead to the accumulation of debt. It’s crucial to assess your overall financial situation, ensure you have a clear repayment plan, and avoid taking on more debt than you can comfortably handle.

It’s important to weigh these disadvantages against the advantages and make an informed decision about whether Afterpay is the right payment option for your individual circumstances. Responsible budgeting, understanding the terms and conditions, and making timely payments are essential for maximizing the benefits of using Afterpay while minimizing potential drawbacks.

FAQ

How can you be penalized for not paying Afterpay?

If you fail to pay Afterpay, there can be several consequences and actions taken by Afterpay to recover the outstanding debt. While these consequences are related to financial repercussions, it’s important to note that they are not criminal penalties. Here are some potential actions Afterpay may take:

- Late Fees and Charges: Afterpay may impose late fees if you miss a payment or fail to make payments on time. These fees can vary, but they typically add to the overall cost of your purchase and increase your outstanding debt.

- Debt Collection Activities: After a certain period of non-payment, Afterpay may engage a debt collection agency to pursue the outstanding debt on their behalf. The debt collection agency will contact you to request payment and may employ various methods to recover the debt, such as phone calls, letters, or legal actions.

- Credit Score Impact: Afterpay may report late or missed payments to credit reporting agencies. This can negatively impact your credit score, making it more challenging to obtain future loans, credit, or favorable interest rates.

- Inability to Use Afterpay: If you consistently fail to meet your payment obligations with Afterpay, they may restrict or suspend your ability to use their service for future purchases until the outstanding debt is resolved.

It’s important to note that these consequences and actions are within the realm of civil law, where the focus is on recovering the debt rather than pursuing criminal charges. Afterpay cannot send you to jail or involve law enforcement solely due to non-payment.

If you are experiencing financial hardship or anticipate difficulty in meeting your Afterpay payments, it is advisable to contact Afterpay directly. They may be able to offer assistance, alternative payment arrangements, or provide guidance on managing your payments effectively.

Remember, this response provides general information and should not be considered legal advice. If you have specific concerns or legal questions regarding your Afterpay situation, it’s best to consult with a legal professional or financial advisor.

Related Video: What happens if you never pay Afterpay?

Final Thoughts

It is important to emphasize that you cannot go to jail for not paying Afterpay. Afterpay operates as a payment facilitator and is not a creditor or lender. Non-payment of an Afterpay debt falls under civil law, and the consequences are related to financial repercussions rather than criminal penalties.

While failing to pay Afterpay can have serious consequences, such as late fees, debt collection activities, and potential impact on your credit score, these actions are focused on recovering the outstanding debt rather than pursuing criminal charges. Afterpay cannot send you to jail or involve law enforcement solely due to non-payment.

Responsible financial behavior is crucial, and it is important to honor your commitments and fulfill your payment obligations. By understanding the terms and conditions of your Afterpay agreement and managing your payments effectively, you can avoid potential negative consequences and maintain a healthy financial standing.

If you encounter financial difficulties or are unable to meet your Afterpay obligations, it is recommended to communicate with Afterpay directly. They may offer assistance, alternative payment arrangements, or provide guidance on how to manage your payments more effectively.

Remember, the information provided in this article is intended for general guidance and should not be considered legal advice. If you have specific concerns or legal questions regarding your Afterpay situation, it is best to seek advice from a legal professional or financial advisor who can provide personalized guidance based on your circumstances.