Apple Pay is a widely used digital payment system that allows users to make secure payments using their Apple devices. While it offers several security features to protect users from fraudulent activities, there is always a possibility of scammers attempting to exploit the system. In the event that a user falls victim to a scam while using Apple Pay, a common question that arises is whether Apple Pay refunds the money. In this article, we will explore the policies and procedures of Apple Pay regarding refunds for scams and provide insights into what users can do to protect themselves from potential scams.

So, Does Apple Pay Refund Money if Scammed?

If you have been scammed while using Apple Pay, you may wonder whether Apple will refund the money you lost. The answer to this question is not straightforward, as it depends on various factors, such as the circumstances of the scam and the specific policies of Apple Pay.

In general, Apple Pay provides a range of security features to protect users from fraudulent activities, such as tokenization, encryption, and biometric authentication. However, despite these measures, scammers may still be able to trick users into sending money or making purchases using their Apple Pay accounts.

If you believe that you have been scammed while using Apple Pay, the first step is to contact Apple Pay support as soon as possible. Apple’s support team will investigate the situation and determine whether a refund is possible. In some cases, Apple Pay may issue a refund for the unauthorized transactions or purchases made through your account. However, this is not always guaranteed, and the refund amount may vary depending on the specific circumstances.

It’s worth noting that Apple Pay’s refund policies may differ depending on the region and the specific payment method used. For example, if you use a credit or debit card with Apple Pay, you may be able to dispute the charges with your bank or card issuer instead of Apple Pay directly.

While Apple Pay provides several security features to protect users from scams, there is always a risk of fraudulent activities. If you suspect that you have fallen victim to fraud while utilizing Apple Pay, it is advisable to promptly reach out to Apple Pay support, report the incident, and request a reimbursement. However, it’s also important to take proactive measures to protect yourself from potential scams, such as avoiding sharing your account details with strangers and verifying the authenticity of requests before sending money or making purchases.

How To Refund Money If I Was Scammed Using Apple Pay?

If you believe that you have been scammed while using Apple Pay and want to request a refund, there are several steps you can take:

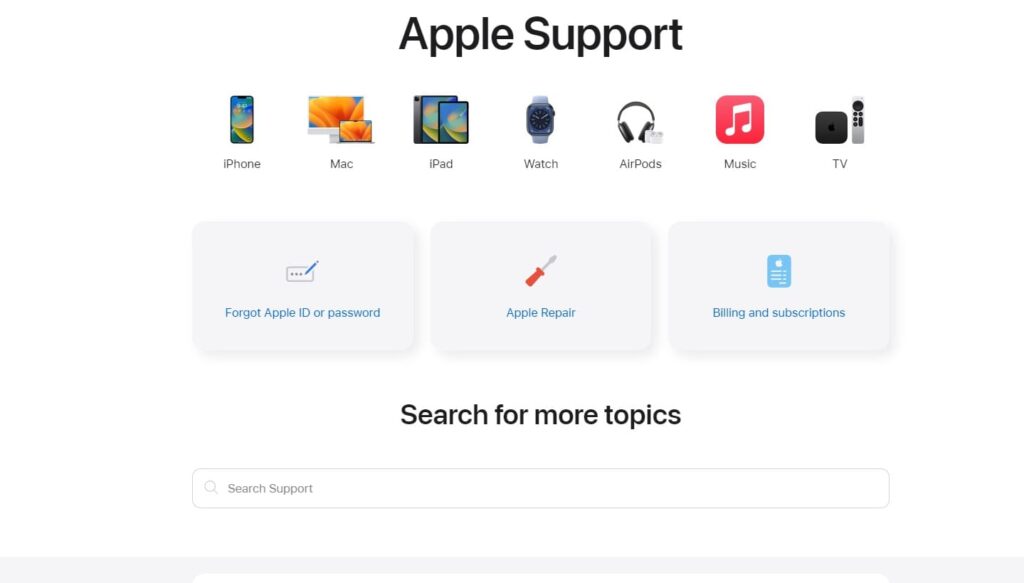

- Contact Apple Pay Support: The first step is to contact Apple Pay support as soon as possible. You can do this by visiting the Apple Pay support website, selecting your issue, and choosing to contact Apple Pay support via phone, chat, or email. Explain the situation to the support team and provide any relevant details or evidence, such as transaction records or screenshots.

- Provide Necessary Information: The support team may ask you to provide additional information, such as your Apple Pay account details, the date and time of the unauthorized transaction or purchase, and any communication you had with the scammer. Make sure to provide accurate and complete information to help with the investigation.

- Wait for Investigation: After you report the issue, the Apple Pay support team will investigate the situation and determine whether a refund is possible. This process may take some time, and the outcome will depend on the specific circumstances of the scam. In some cases, Apple Pay may issue a refund for the unauthorized transactions or purchases made through your account.

- Follow Up: If you don’t hear back from the Apple Pay support team within a reasonable timeframe, you can follow up with them to check the status of your request. Be polite but persistent, and provide any additional information or evidence that may help with the investigation.

- Take Preventive Measures: While waiting for the investigation to be completed, you can take preventive measures to protect yourself from potential scams in the future. For example, you can enable two-factor authentication for your Apple Pay account, avoid sharing your account details with strangers, and verify the authenticity of requests before sending money or making purchases.

If you’ve fallen victim to a scam while using Apple Pay, it’s crucial to reach out to Apple Pay support as soon as possible and give them all the necessary details to request a refund. Additionally, it’s vital to be proactive in safeguarding yourself against potential scams in the future.

How Can I Be Scammed Using Apple Pay?

While Apple Pay is a secure payment system that offers several features to protect users from scams, there are still some ways that scammers can attempt to exploit the system. Here are some common methods scammers use to trick users into sending money or making purchases using Apple Pay:

- Social Engineering: Scammers may use social engineering techniques to trick users into revealing their account details or sending money. For example, they may pose as a friend or family member in distress and ask for urgent financial help, or they may send a phishing email or text message that appears to be from Apple Pay and ask the user to provide their account information.

- Fake or Stolen Cards: Scammers may use fake or stolen credit or debit cards to make unauthorized purchases using Apple Pay. They may obtain the card information through various means, such as skimming or hacking.

- Malware or Phishing: Scammers may use malware or phishing techniques to gain access to the user’s Apple Pay account. For example, they may trick the user into downloading a malicious app or clicking on a phishing link that steals their account information.

- Fake Merchants: Scammers may create fake merchant accounts on Apple Pay and offer fake or counterfeit goods for sale. They may then use the user’s account information to make unauthorized purchases or withdraw money from their account.

To protect yourself from potential scams on Apple Pay, you should always be cautious when sharing your account information, and be sure to verify the authenticity of requests before sending money or making purchases. You should also enable two-factor authentication for your Apple Pay account, regularly monitor your account activity, and report any suspicious transactions or activities to Apple Pay support immediately.

How Not To Be Scammed Using Apple Pay?

There are several steps you can take to protect yourself from potential scams on Apple Pay:

- Enable Two-Factor Authentication: Two-factor authentication adds an extra layer of security to your Apple Pay account by requiring a second form of authentication, such as a fingerprint or passcode, to complete a transaction. This can help prevent unauthorized access to your account.

- Verify the Authenticity of Requests: Be cautious of any requests for money or purchases, especially if they come from someone you don’t know or trust. Take the time to verify the authenticity of the request before sending any money or making a purchase. For example, you can contact the person or business directly through a known phone number or email address to confirm the request.

- Only Use Trusted Merchants: When making purchases through Apple Pay, make sure to only use trusted merchants. Avoid making purchases from unfamiliar or suspicious-looking websites or apps.

- Monitor Your Account Activity: Regularly check your Apple Pay account activity to ensure that all transactions are legitimate. If you notice any unauthorized transactions or suspicious activity, contact Apple Pay support immediately.

- Keep Your Account Information Safe: Protect your account information, including your Apple ID and password, and never share it with anyone. Be cautious of any unsolicited requests for your account information, as they may be attempts to scam you.

By taking these steps to protect yourself from potential scams, you can use Apple Pay with confidence and reduce the risk of falling victim to fraudulent activities. Always be vigilant and cautious when using any payment system, and report any suspicious activity to the appropriate authorities immediately.

What Should I Do If My Money Does Not Refund When I Was Scammed Using Apple Pay?

If you have been scammed on Apple Pay and your request for a refund has been denied, there are still several steps you can take:

- Contact Apple Pay Support Again: If your request for a refund has been denied, contact Apple Pay support again and explain your situation. Provide any additional evidence or information that you may have, such as transaction records or screenshots, to support your case.

- Contact Your Bank or Credit Card Company: If Apple Pay support is unable to help, contact your bank or credit card company and explain the situation. They may be able to reverse the unauthorized transactions or purchases made through your account.

- File a Complaint with Consumer Protection Agencies: If you have exhausted all other options and still cannot get a refund, consider filing a complaint with consumer protection agencies, such as the Federal Trade Commission (FTC) or your state’s attorney general’s office.

- Seek Legal Advice: If you have suffered significant financial losses due to the scam, you may want to consider seeking legal advice. A lawyer can help you understand your rights and options for pursuing legal action against the scammer or any other parties involved.

If your request for a refund has been denied after being scammed on Apple Pay, don’t give up. Contact Apple Pay support again, contact your bank or credit card company, file a complaint with consumer protection agencies, and seek legal advice if necessary. With persistence and the right resources, you may be able to recover your losses and hold the scammers accountable for their actions.

FAQ

How will Apple Pay solve the fraud problem?

Apple Pay takes several measures to help prevent scams and protect its users. Here are some ways Apple Pay is working to solve the problem of scams:

- Secure Encryption: Apple Pay uses end-to-end encryption to protect user data, including payment information, from unauthorized access. This means that payment information is encrypted on the device and cannot be accessed by anyone, including Apple, without the user’s permission.

- Two-Factor Authentication: Apple Pay requires two-factor authentication to complete a transaction, adding an extra layer of security to prevent unauthorized access to user accounts.

- Fraud Detection and Prevention: Apple Pay uses advanced fraud detection and prevention technologies to identify and block suspicious transactions, such as those involving stolen or fake cards.

- Dispute Resolution: Apple Pay offers a dispute resolution process that allows users to report any unauthorized transactions or suspicious activity and seek a refund.

- Regular Security Updates: Apple Pay regularly releases security updates and patches to address any known vulnerabilities or threats, helping to keep its users’ data and transactions secure.

In addition to these measures, Apple Pay also works closely with financial institutions, merchants, and other partners to develop and implement best practices for preventing scams and protecting users. By taking a proactive approach to security and continually improving its systems and technologies, Apple Pay is helping to solve the problem of scams and ensure a safe and secure payment experience for its users.

How to stay safe at Apple Pay?

To stay safe while using Apple Pay, here are some tips to keep in mind:

- Use Strong Passwords: Use strong, unique passwords for your Apple ID and any other accounts associated with your Apple Pay account. Consider using a password manager to generate and store secure passwords.

- Enable Two-Factor Authentication: Enable two-factor authentication to add an extra layer of security to your Apple Pay account. This will require a second form of authentication, such as a fingerprint or passcode, to complete a transaction.

- Only Use Trusted Merchants: Only make purchases through trusted merchants and avoid using unfamiliar or suspicious-looking websites or apps.

- Verify Requests: Verify any requests for money or purchases, especially if they come from someone you don’t know or trust. Take the time to confirm the authenticity of the request before sending any money or making a purchase.

- Monitor Your Account Activity: Regularly check your Apple Pay account activity to ensure that all transactions are legitimate. If you notice any unauthorized transactions or suspicious activity, contact Apple Pay support immediately.

- Keep Your Device Secure: Keep your device secure by using a passcode or biometric authentication, such as Touch ID or Face ID. Keep your device up-to-date with the latest software updates and security patches.

- Protect Your Personal Information: Protect your personal information, including your Apple ID and password, and never share it with anyone. Be cautious of any unsolicited requests for your account information, as they may be attempts to scam you.

By following these tips and being vigilant while using Apple Pay, you can help to ensure a safe and secure payment experience.

Which alternatives can I use for Apple Pay?

There are several alternatives to Apple Pay that offer similar functionality and convenience. Here are some popular options:

- Google Pay: Google Pay is a mobile payment app developed by Google. It allows users to store credit and debit card information and make payments through their mobile devices. Google Pay is available for both Android and iOS devices.

- Samsung Pay: Samsung Pay is a mobile payment app developed by Samsung. It uses both near-field communication (NFC) and magnetic secure transmission (MST) technologies to allow users to make payments at both NFC-enabled and traditional payment terminals. Samsung Pay is available for select Samsung Galaxy devices.

- PayPal: PayPal is an online payment platform that allows users to send and receive money, make purchases, and store payment information securely. PayPal is available for both desktop and mobile devices.

- Venmo: Venmo is a mobile payment app owned by PayPal that allows users to send and receive money, split bills, and make purchases using their mobile devices. Venmo is available for both iOS and Android devices.

- Square Cash: Square Cash is a mobile payment app developed by Square. It allows users to send and receive money using their mobile devices, as well as make purchases through participating merchants. Square Cash is available for both iOS and Android devices.

These are just a few examples of the many alternatives to Apple Pay that are available. Each app has its own unique features and benefits, so it’s important to research and compare them to find the one that best fits your needs.

Related Video: Will Apple Pay refund money if scammed?

Conclusion

Apple Pay offers a secure and convenient way to make payments using your mobile device. While the platform takes several measures to help prevent scams and protect users, it’s still possible to fall victim to scams. If you believe you have been scammed on Apple Pay, it’s important to act quickly and report the incident to Apple Pay support. By doing so, you may be able to receive a refund for any unauthorized transactions or suspicious activity. To avoid scams, be sure to use strong passwords, enable two-factor authentication, only use trusted merchants, verify requests, monitor your account activity, keep your device secure, and protect your personal information. Additionally, there are several alternatives to Apple Pay available, each with its own unique features and benefits. By taking the necessary precautions and staying informed about your payment options, you can help to ensure a safe and secure payment experience.