Google Pay is a popular mobile payment app that allows users to make transactions quickly and easily with just a few taps on their smartphone. One of the key advantages of Google Pay is its convenience, as it enables users to make payments without having to carry cash or credit cards. However, many people wonder if Google Pay can be used offline, particularly in areas with poor network coverage or no internet access. In this article, we will explore the functionality of Google Pay when it comes to offline payments and examine the different factors that determine whether or not the app can be used without an internet connection.

So, Does Google Pay Work Offline?

The answer to whether Google Pay works offline is not straightforward, as it depends on several factors. In general, Google Pay is designed to work online, and most of its features require an internet connection to function properly. However, the app does offer some limited offline functionality, particularly for making payments in areas with poor network coverage or no internet access.

If you have an active internet connection, Google Pay can be used to make payments at any merchant that accepts mobile payments. However, if you lose internet connectivity during a transaction, the payment may fail, and you may have to retry the transaction once you regain network coverage.

In some cases, Google Pay may also be able to process offline transactions using a technology called Near Field Communication (NFC). NFC allows two devices to communicate with each other wirelessly, even if they are not connected to the internet. To use NFC, both the merchant’s payment terminal and your smartphone must be equipped with the technology. If they are, you may be able to make payments using Google Pay even if you don’t have an internet connection.

In summary, while Google Pay is primarily an online payment app, it does offer some limited offline functionality for making payments in areas with poor network coverage or no internet access. However, whether or not Google Pay works offline ultimately depends on the specific circumstances of the transaction and the technology available at the point of sale.

Why Can You Only Use Google Pay With Internet?

Google Pay, like many other mobile payment apps, requires an active internet connection to function properly. This is because Google Pay is a cloud-based service, which means that it relies on a connection to Google’s servers to process transactions and authenticate payments.

When you make a payment with Google Pay, the app communicates with the merchant’s payment terminal and sends a message to Google’s servers to verify your payment credentials and authorize the transaction. If there is no internet connection available, the app cannot communicate with Google’s servers and therefore cannot process the payment.

Additionally, Google Pay uses a variety of security measures to protect your payment information and prevent fraud. These security features rely on a connection to Google’s servers to function properly. Without an internet connection, the app may not be able to authenticate your identity or verify the security of the transaction, which could potentially lead to unauthorized charges or other security risks.

Google Pay requires an internet connection to function properly because it is a cloud-based service that relies on a connection to Google’s servers to process payments and provide security features. While there are some limited offline payment options available, these typically rely on specialized technologies such as NFC and may not be available in all situations.

Which Alternatives Can I Use For Google Pay That Work Offline?

If you are looking for an alternative to Google Pay that works offline, there are a few options available to you. However, it’s important to note that most mobile payment apps require an internet connection to function properly, and offline payment options are generally limited.

One alternative to Google Pay that offers some offline functionality is Samsung Pay. Like Google Pay, Samsung Pay uses NFC technology to enable mobile payments, but it also includes a feature called Magnetic Secure Transmission (MST) that allows it to communicate with traditional magstripe card readers. This means that Samsung Pay can be used to make payments even in areas with poor network coverage or no internet access.

Another option is to use a mobile wallet app that supports offline payments using QR codes. These apps allow you to generate a QR code on your smartphone, which the merchant can scan to initiate the payment. While this method still requires an active internet connection to complete the transaction, it may be useful in situations where network coverage is poor or unstable.

Some examples of mobile wallet apps that support QR code payments and may offer limited offline functionality include:

- Paytm

- PhonePe

- BHIM

- Mobikwik

In summary, while most mobile payment apps require an internet connection to function properly, some alternatives to Google Pay offer limited offline functionality. Samsung Pay is one option that supports NFC and MST technology, while mobile wallet apps that support QR code payments may also be useful in areas with poor network coverage.

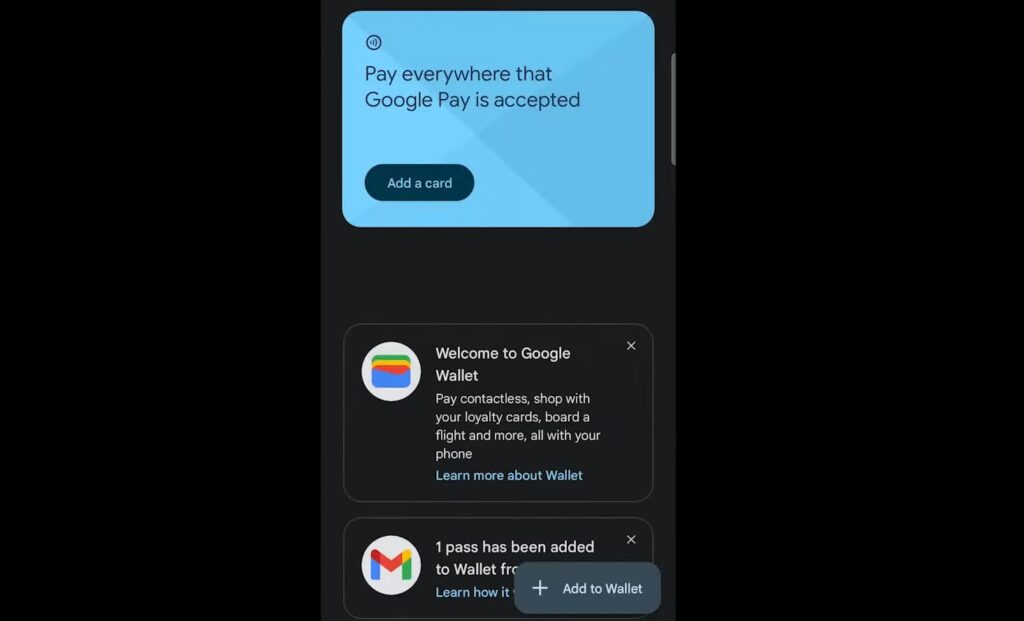

How to Use Google Pay?

Using Google Pay is simple and straightforward, and it can be set up in just a few steps. Here’s a general guide on how to use Google Pay:

- Download and install the Google Pay app from the Google Play Store (for Android devices) or the App Store (for iOS devices).

- Open the Google Pay app and follow the on-screen prompts to sign in to your Google account and set up the app.

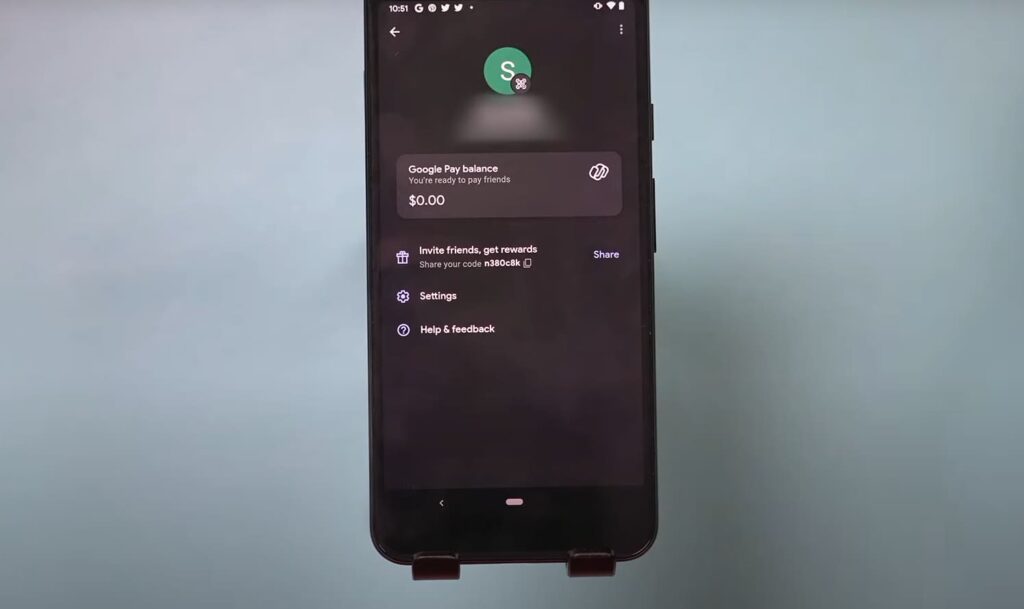

- Add a payment method to your account. You can add credit or debit cards, bank accounts, and even loyalty cards to your Google Pay account. To add a payment method, select “Payment methods” from the app menu and follow the instructions to enter your card or account information.

- Once you have added a payment method, you can use Google Pay to make payments at participating merchants. To make a payment, simply unlock your phone and hold it near the payment terminal. The app will automatically detect the terminal and prompt you to complete the payment.

- Confirm the payment details and authorize the transaction. Depending on the merchant, you may need to enter a PIN or sign a receipt to complete the payment.

In addition to making payments, Google Pay also offers other features such as peer-to-peer payments, the ability to store digital tickets and passes, and integration with loyalty programs. These features can be accessed from the app menu.

It’s important to note that some features of Google Pay may not be available in all countries or regions, and the app may not be compatible with all payment terminals or mobile devices. Additionally, Google Pay may require an active internet connection to function properly, although some limited offline payment options may be available in certain situations.

Advantages Of Using Google Pay

There are several advantages to using Google Pay, including:

- Convenience: Google Pay makes it easy to make payments with just a few taps on your phone. You no longer need to carry cash or cards, which can be convenient in situations where you don’t have your wallet with you.

- Security: Google Pay uses multiple layers of security to protect your payment information, including encryption, tokenization, and biometric authentication. This can help prevent fraud and unauthorized transactions.

- Speed: Google Pay transactions are typically faster than traditional payment methods, as you don’t need to fumble with cards or wait for receipts to be printed.

- Integration: Google Pay integrates with a wide range of apps and services, including online merchants and loyalty programs. This can make it easy to manage your finances and rewards in one place.

- Rewards: Some credit and debit cards offer rewards for using Google Pay to make purchases, such as cashback or points. These rewards can add up over time and provide additional value to using the service.

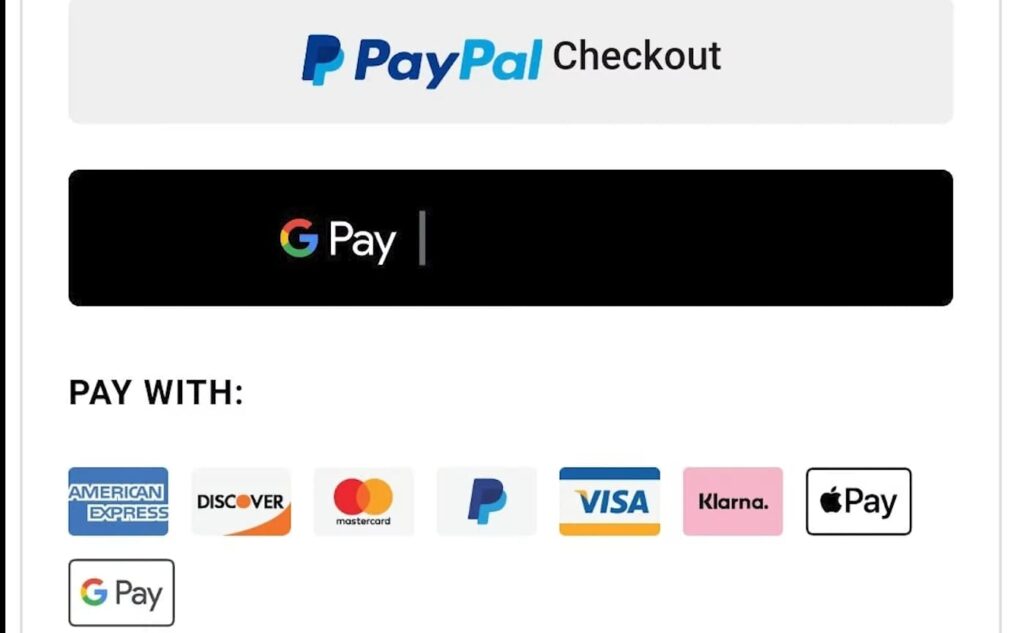

- Availability: Google Pay is widely accepted at many merchants, and it can be used in countries around the world. This makes it a versatile payment option that can be used for a variety of transactions.

Google Pay offers a convenient, secure, and versatile way to make payments using your mobile device. While there may be some limitations and disadvantages to using the service, the benefits it provides can make it a valuable addition to your financial toolkit.

Disadvantages Of Using Google Pay

While Google Pay offers many advantages, there are also some potential disadvantages to using the service. These include:

- Limited offline functionality: As mentioned earlier, Google Pay requires an active internet connection to function properly. This means that in areas with poor network coverage or no internet access, you may not be able to use the service.

- Compatibility issues: Google Pay may not be compatible with all payment terminals or mobile devices. Some older or less common devices may not support the service, which could limit its usefulness in certain situations.

- Privacy concerns: Google collects data on how you use Google Pay, such as your transaction history, in order to improve its services and target advertisements. While this information is generally kept private and secure, some users may have concerns about their privacy and data security.

- Potential for fraud: While Google Pay uses multiple layers of security to protect your payment information, there is always a risk of fraud or unauthorized transactions. If your phone is lost or stolen, someone could potentially make purchases using your account without your knowledge.

- Fees: While using Google Pay itself is free, some banks or credit card issuers may charge fees for using the service. These fees can vary depending on the type of transaction, so it’s important to check with your bank or issuer to understand any potential costs.

- Dependency on technology: Using Google Pay requires a smartphone or other compatible mobile device, which can be a disadvantage for people who prefer to use cash or traditional payment methods. It also means that if your phone runs out of battery or malfunctions, you may not be able to make payments.

While there are some potential disadvantages to using Google Pay, many users find that the benefits outweigh the risks. It’s important to weigh the pros and cons carefully and consider your own financial needs and preferences before deciding whether to use the service.

FAQ

Will Google Pay work without the Internet?

Google Pay typically requires an active internet connection to function properly, as it relies on network connectivity to process transactions and authenticate payments. However, in some limited scenarios, Google Pay may be able to work without an internet connection.

For example, if you have previously set up a payment method in Google Pay and enabled offline payments, you may be able to make a payment even if you don’t have an internet connection. This feature is supported by some payment terminals and requires that both the terminal and your phone have NFC (Near Field Communication) capabilities.

It’s important to note that offline payments are not available in all countries or regions, and not all payment terminals support this feature. Additionally, offline payments may have certain limitations or restrictions, such as transaction limits or the inability to process refunds.

In general, it’s recommended to use Google Pay with an active internet connection whenever possible to ensure that transactions are processed quickly and securely.

How can I use Google Pay?

To use Google Pay, you’ll need a compatible Android smartphone or wearable device with NFC (Near Field Communication) capabilities and an active internet connection. Here’s how to set up and use Google Pay:

- Download the Google Pay app: If your phone doesn’t come pre-installed with the app, you can download it for free from the Google Play Store.

- Add payment methods: Follow the on-screen instructions to add credit or debit cards to your Google Pay account. You may need to verify your card by entering a code sent by your bank or by making a small transaction.

- Set up screen lock: For security purposes, Google Pay requires that you set up a screen lock on your phone, such as a PIN, pattern, or fingerprint scan.

- Enable NFC and Google Pay: Make sure that NFC is enabled on your device and that Google Pay is set as your default payment app. You can do this by going to Settings > Connected devices > Connection preferences > NFC, and then selecting Google Pay as your default payment app.

- Make a payment: To make a payment with Google Pay, simply hold your phone near a contactless payment terminal and wait for the payment to be processed. You may need to unlock your phone and authorize the payment with your screen lock or biometric authentication.

- Manage transactions: You can view your transaction history, manage payment methods, and redeem rewards through the Google Pay app.

It’s important to note that Google Pay may not be accepted at all merchants or in all countries or regions. Additionally, some banks or credit card issuers may charge fees for using Google Pay, so be sure to check with your financial institution for more information.

What can I do offline at Google Pay?

Google Pay is primarily an online payment platform, meaning that it requires an active internet connection to function properly. However, there are a few limited offline features that may be available, depending on your location and the specific payment terminal you’re using. These include:

- Offline payments: In some cases, you may be able to make payments with Google Pay even if you don’t have an internet connection. This feature is supported by some payment terminals and requires that both the terminal and your phone have NFC (Near Field Communication) capabilities. It’s important to note that offline payments may have certain limitations or restrictions, such as transaction limits or the inability to process refunds.

- View recent transactions: You may be able to view recent transactions in the Google Pay app even if you don’t have an internet connection. However, this feature is limited to transactions that have been processed by your device within the past few days.

- Redeem rewards and offers: Some rewards or offers may be available for redemption offline, such as cashback or loyalty rewards. However, this will depend on the specific offer and whether it requires internet connectivity for redemption.

While there are some limited offline features available on Google Pay, the platform is primarily designed to be used with an active internet connection.

Where can I use Google Pay?

Google Pay is accepted at a wide variety of merchants, both online and offline, including:

- Retail stores: Many brick-and-mortar retailers, such as Walmart, Target, and Best Buy, accept Google Pay for in-store purchases.

- Restaurants and cafes: Many restaurants and cafes accept Google Pay for both in-store and online orders.

- Gas stations: Some gas stations, such as ExxonMobil and Shell, accept Google Pay for fuel purchases.

- Public transportation: Many public transportation systems, such as buses and trains, accept Google Pay for ticket purchases.

- Online merchants: Google Pay can be used for online purchases at a variety of merchants, including Airbnb, Etsy, and StubHub.

It’s important to note that Google Pay may not be accepted at all merchants or in all countries or regions. Additionally, some merchants may have specific requirements or limitations on the use of Google Pay, such as transaction limits or the requirement to use a specific payment method. It’s always a good idea to check with the merchant or service provider to confirm their acceptance of Google Pay before making a purchase.

Why should I not use Google Pay?

While Google Pay offers many benefits, there are certain situations in which it may not be the best payment option. Here are a few examples:

- Large transactions: Google Pay may not be the best option for large transactions, such as buying a car or a house, as there may be transaction limits that could prevent you from making the full payment through the platform.

- Payments to individuals: Google Pay is primarily designed for payments to merchants and businesses. While it is possible to send money to friends or family members through the platform, it may not be the best option for large or frequent payments.

- Unauthorized transactions: While Google Pay offers strong security measures, it’s still important to take precautions to protect your account and prevent unauthorized transactions.

- If you suspect that your account has been compromised or that a transaction was made without your consent, it’s important to contact Google Pay support immediately.

- In countries or regions where Google Pay is not supported: While Google Pay is available in many countries and regions, it may not be supported in all locations. If you’re traveling to a new country or region, it’s a good idea to check whether Google Pay is accepted and supported before relying on it for payments.

While Google Pay is a convenient and secure payment platform, it’s important to consider your individual needs and circumstances before deciding whether it’s the right payment option for you.

Related Video: How to Use Google Pay to Spend Money More Wisely

Summarize

Google Pay is primarily an online payment platform that requires an active internet connection to function properly. While there are some limited offline features available, such as the ability to make payments with certain payment terminals or view recent transactions, these features are not available in all countries or regions and may have certain limitations or restrictions.

It’s important to note that using Google Pay with an active internet connection is the most secure and efficient way to make payments. Additionally, Google Pay offers a range of benefits, such as fast and convenient payments, rewards and offers, and easy transaction management, that make it a popular choice among users.

Ultimately, whether or not Google Pay is the right payment solution for you will depend on your individual needs and preferences, as well as the availability of the platform in your location. It’s always a good idea to compare different payment options and weigh the pros and cons before making a decision.