The mobile payment market is an ever-growing industry, and Samsung Pay has become an important player in the space. Samsung Pay is a digital wallet that allows users to make purchases with their mobile phones. It’s a convenient way to pay without needing to carry cash or a physical credit/debit card. With its convenience and popularity, it’s no surprise why people are wondering why Samsung Pay keeps opening.

There could be several reasons why Samsung Pay keeps opening on your device. Here are some possible reasons and solutions:

- Accidental activation: You might be accidentally triggering Samsung Pay by pressing the dedicated hardware button or swiping up from the bottom of the screen. To prevent this, you can disable the hardware button shortcut or change the swipe gesture in the Samsung Pay settings.

- Automatic activation: Samsung Pay may be automatically activating when you are near a payment terminal or a magnetic stripe reader. You can turn off the automatic activation feature in the Samsung Pay settings.

- Outdated app: If you haven’t updated Samsung Pay in a while, it might be causing some glitches that cause it to keep opening. Try updating the app to the latest version from the Google Play Store or the Galaxy Store.

- Third-party app conflicts: Samsung Pay may be conflicting with another app that you have installed on your device. Try uninstalling any recently installed apps or ones that you suspect could be causing the issue.

- Malware or virus: If none of the above solutions work, it’s possible that your device is infected with malware or a virus that’s causing Samsung Pay to keep opening. Try running a virus scan using a reputable antivirus app and remove any detected threats.

If the issue persists after trying these solutions, you may want to contact Samsung support or your device manufacturer for further assistance.

How You Сan Fix The Problem Of Constant Opening Of Samsung Pay?

If Samsung Pay keeps opening on your device, here are some steps you can take to fix the issue:

- Disable the Samsung Pay shortcut button: If you are accidentally triggering Samsung Pay by pressing the dedicated hardware button, you can disable this shortcut. To do this, open Samsung Pay, tap the three dots in the top right corner, select “Settings,” and then turn off the “Use Favorite Cards” option.

- Turn off automatic activation: Samsung Pay may be automatically activating when you are near a payment terminal or a magnetic stripe reader. You can turn off this feature by opening Samsung Pay, tapping the three dots in the top right corner, selecting “Settings,” and then turning off the “Automatic Activation” option.

- Clear cache and data: Sometimes, clearing the cache and data of Samsung Pay can help resolve issues. To do this, go to “Settings” > “Apps” > “Samsung Pay” > “Storage” > “Clear Cache” and “Clear Data.”

- Uninstall and reinstall the app: If clearing the cache and data doesn’t work, try uninstalling and reinstalling the Samsung Pay app. To do this, go to “Settings” > “Apps” > “Samsung Pay” > “Uninstall.” Then reinstall the app from the Google Play Store or the Galaxy Store.

- Update the app: If you haven’t updated Samsung Pay in a while, updating to the latest version may help resolve any bugs or issues. To update the app, go to the Google Play Store or the Galaxy Store, search for Samsung Pay, and select “Update.”

If the above steps do not resolve the issue, you may want to contact Samsung support or your device manufacturer for further assistance.

When The Problem Of Constant Opening Of Samsung Pay Will Solved?

Once you have taken the necessary steps to fix the issue of Samsung Pay constantly opening on your device, you should no longer experience the problem. The exact time frame for when the problem will be solved depends on the cause of the issue and the steps you have taken to fix it.

If you have disabled the Samsung Pay shortcut button or turned off automatic activation, you should notice an immediate improvement in the issue. Clearing the cache and data, uninstalling and reinstalling the app, or updating the app may take a few minutes to complete but should also resolve the issue.

If the problem persists after taking these steps, it’s possible that there may be a deeper issue with your device or the Samsung Pay app. In this case, it may be necessary to contact Samsung support or your device manufacturer for further assistance.

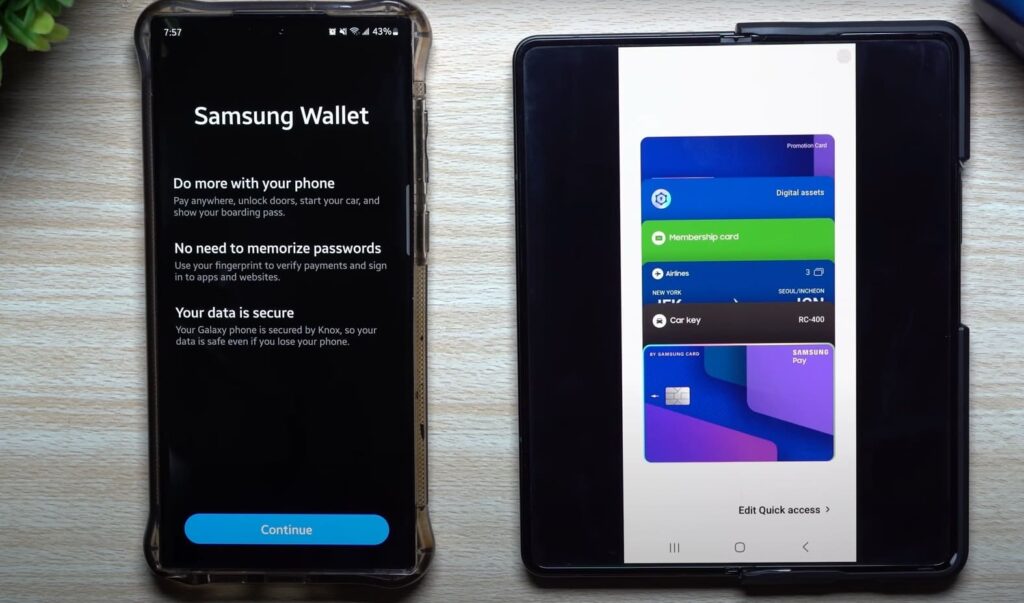

What Is Samsung Pay?

Samsung Pay is a mobile payment and digital wallet service developed by Samsung Electronics. It allows users to make purchases in stores and online using their Samsung smartphones or other compatible Samsung devices, such as smartwatches or tablets.

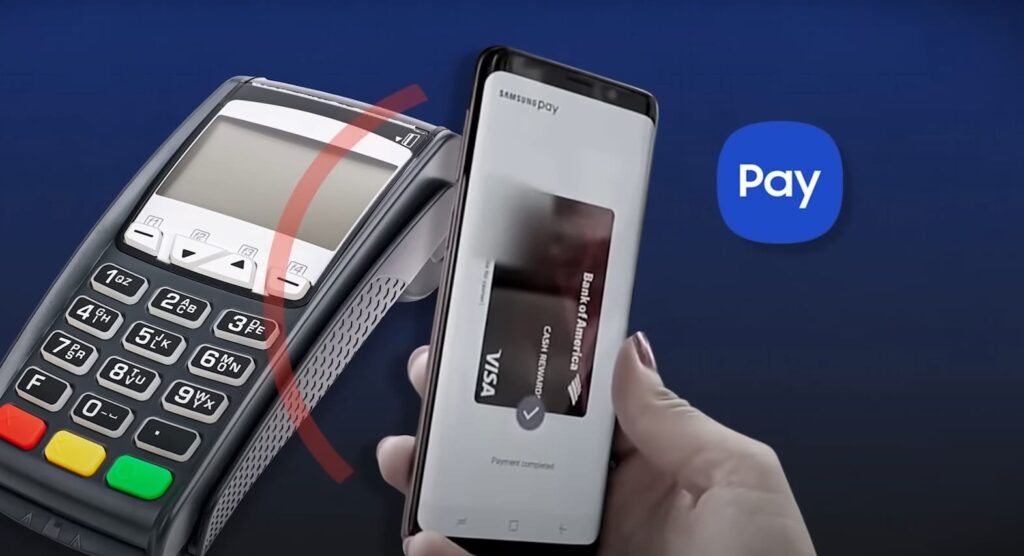

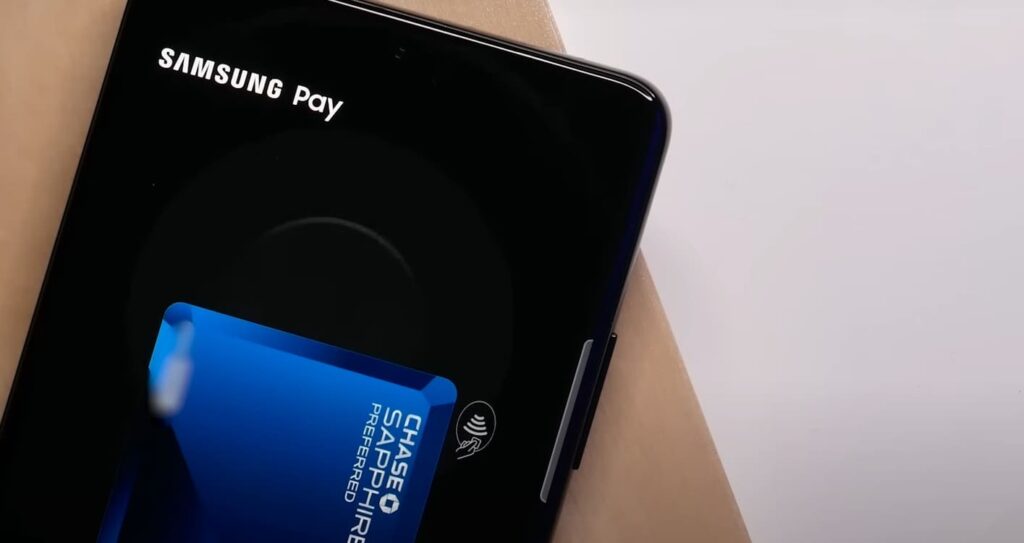

Samsung Pay uses Near Field Communication (NFC) and Magnetic Secure Transmission (MST) technologies to enable payments. NFC allows users to make contactless payments by holding their device near a payment terminal that accepts NFC payments. MST works with older magnetic stripe card readers, allowing users to hold their device close to the card reader and transmit a signal to make a payment.

Samsung Pay also offers features such as the ability to store loyalty cards, gift cards, and membership cards, and track transaction history. It supports a wide range of banks and credit cards globally, and users can add and manage their payment methods within the Samsung Pay app.

Samsung Pay provides a convenient and secure way for users to make payments and manage their finances using their Samsung devices.

Who Created And Owns Samsung Pay?

Samsung Pay was created and is owned by Samsung Electronics, which is a South Korean multinational electronics company. Samsung Electronics is one of the largest manufacturers of consumer electronics in the world and produces a wide range of products, including smartphones, tablets, televisions, and home appliances.

Samsung Pay was first launched in South Korea in August 2015, and since then, it has expanded to other markets, including the United States, Europe, and Asia. Samsung Pay operates as a subsidiary of Samsung Electronics, and its development and operations are overseen by the company’s mobile division.

Samsung Pay is one of several mobile payment services offered by major technology companies, including Apple Pay and Google Pay. The service has become increasingly popular due to its convenience, security features, and compatibility with a wide range of payment terminals.

What Collaborations Samsung Pay Has?

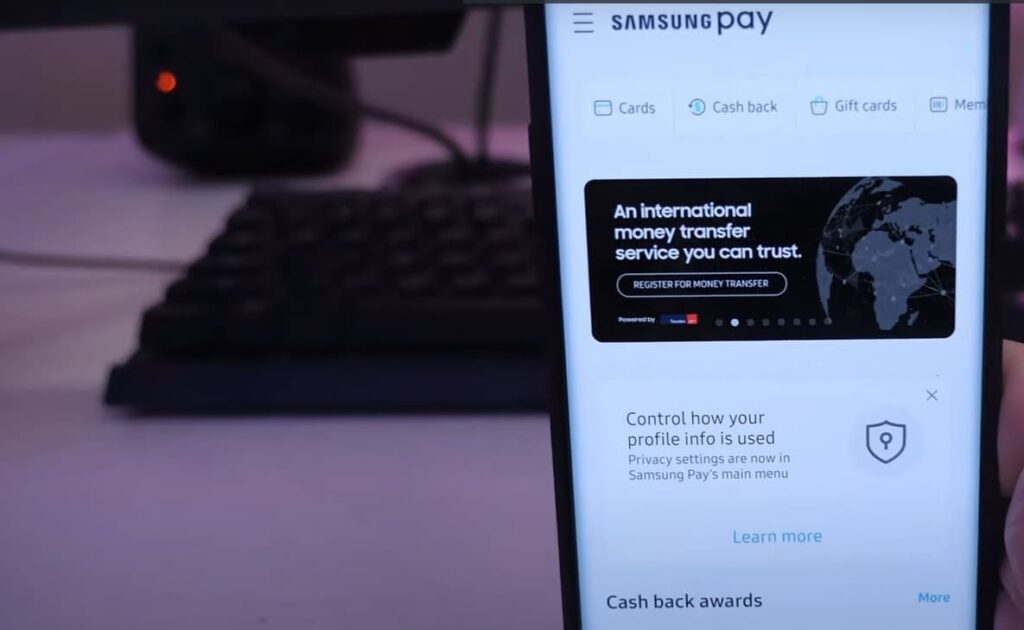

Samsung Pay has collaborated with various financial institutions, payment networks, and merchants to expand its reach and offer more payment options to its users. Here are some examples of Samsung Pay collaborations:

- Payment networks: Samsung Pay has partnered with payment networks such as Mastercard, Visa, and American Express to allow users to add their credit and debit cards to the app.

- Banks and financial institutions: Samsung Pay has collaborated with numerous banks and financial institutions globally to offer users access to their accounts within the app. Some examples of these collaborations include partnerships with Chase, Bank of America, and CitiBank in the US, and with DBS Bank, Standard Chartered, and OCBC Bank in Singapore.

- Merchants: Samsung Pay has collaborated with various merchants to offer discounts and promotions to its users. For example, Samsung Pay users in the US can receive cashback rewards for purchases made at participating merchants such as Walmart, Best Buy, and eBay.

- Transit agencies: Samsung Pay has partnered with public transit agencies in select cities to allow users to pay for fares using the app. For example, users in New York City can use Samsung Pay to pay for fares on the MTA subway and bus system.

Samsung Pay’s collaborations with various institutions and merchants allow it to offer a wide range of payment options and benefits to its users.

What Scandals Samsung Pay Has Had?

Samsung Pay has not been involved in any major scandals. However, Samsung Electronics, the parent company of Samsung Pay, has faced several controversies in the past. Here are some notable examples:

- Galaxy Note 7 Battery Explosions: In 2016, Samsung Electronics faced a major crisis when reports emerged of Galaxy Note 7 smartphones exploding and catching fire due to faulty batteries. The company eventually recalled all units and halted production of the device.

- Corruption Scandal: In 2017, the company’s heir, Lee Jae-yong, was sentenced to five years in prison for his involvement in a corruption scandal that led to the impeachment of South Korea’s former President, Park Geun-hye.

- Labor Rights Violations: Samsung has faced criticism over labor rights violations at some of its manufacturing facilities in countries such as China and Vietnam. Workers have reported long hours, low pay, and unsafe working conditions.

It’s important to note that while these controversies involve Samsung Electronics, they are not directly related to Samsung Pay. Samsung Pay has generally been well-received by users and has not faced any major issues or scandals.

What Is The Main Goal Of Samsung Pay?

The main goal of Samsung Pay is to provide a simple, secure, and convenient mobile payment service to users, allowing them to make payments in stores and online using their Samsung devices. Samsung Pay aims to offer a seamless and integrated payment experience, allowing users to easily manage their finances and make purchases without the need for physical cards or cash.

To achieve this goal, Samsung Pay uses advanced security measures to protect user information and transactions, including tokenization and fingerprint or PIN verification. The service also supports a wide range of payment methods, including credit and debit cards, loyalty cards, and gift cards, and works with a variety of payment terminals, including both NFC and MST-enabled devices.

Samsung Pay also seeks to offer additional features and benefits to its users, such as rewards programs, discounts, and promotions, to incentivize their use of the service. Overall, Samsung Pay’s main goal is to provide a comprehensive and user-friendly mobile payment solution that meets the needs and preferences of consumers.

What Are The Future Plans For Samsung Pay?

Samsung Pay has several future plans and initiatives aimed at improving the user experience and expanding the service’s reach. Here are some of the key areas of focus for Samsung Pay:

- International Expansion: Samsung Pay aims to expand its reach to new markets, particularly in Europe and Latin America, and to partner with more banks and financial institutions globally to increase the number of payment options available to users.

- Integration with Wearables: Samsung Pay plans to further integrate the service with its smartwatch and other wearable devices, allowing users to make payments even more conveniently and easily from their wrists.

- Improved Loyalty Programs: Samsung Pay aims to enhance its loyalty program offerings to provide more benefits and incentives for users to use the service, such as personalized rewards, cashback offers, and promotions.

- Enhanced Security Features: Samsung Pay plans to continue to enhance its security features to ensure user information and transactions are fully protected, including exploring new biometric authentication methods and integrating blockchain technology.

- Integration with Emerging Technologies: Samsung Pay aims to integrate with emerging technologies such as 5G, Internet of Things (IoT), and augmented reality (AR) to offer new and innovative payment experiences for users.

Samsung Pay’s future plans are focused on improving the user experience, expanding its reach, and offering new and innovative payment solutions to meet the changing needs and preferences of consumers.

Advantages Of Samsung Pay

Samsung Pay offers several advantages over traditional payment methods, including:

- Convenience: Samsung Pay allows users to make payments quickly and easily using their mobile devices, eliminating the need to carry around physical cards or cash. Users can add multiple cards to the app and choose which one to use for each transaction.

- Security: Samsung Pay uses advanced security measures to protect user information and transactions, including tokenization and fingerprint or PIN verification. This makes it a secure payment option, as users do not need to share their card information with merchants.

- Compatibility: Samsung Pay is compatible with a wide range of payment terminals, including both NFC and MST-enabled devices, making it more versatile and accessible than some other mobile payment options.

- Rewards Programs: Samsung Pay offers various rewards programs, discounts, and promotions to incentivize users to use the service. These benefits may include cashback offers, personalized rewards, and other special deals.

- Integration with Samsung Devices: Samsung Pay is integrated with Samsung devices, making it easy for Samsung users to access and use the service. Additionally, Samsung Pay works with Samsung Smartwatch and other wearable devices, allowing users to make payments from their wrists.

Samsung Pay offers a convenient, secure, and versatile mobile payment solution with added benefits such as rewards programs and compatibility with Samsung devices.

Disadvantages Of Samsung Pay

While Samsung Pay offers several advantages, there are also some potential disadvantages to consider, including:

- Limited Availability: Samsung Pay is not available in all countries and may not be supported by all banks or financial institutions, limiting its accessibility to some users.

- Device Compatibility: Samsung Pay is only available on Samsung devices, so users with other types of smartphones cannot use the service. Additionally, some older Samsung devices may not be compatible with Samsung Pay.

- Reliance on Technology: Samsung Pay requires a smartphone with a working internet connection and NFC or MST technology, which may not always be available. This means that users may not be able to make payments if they are in an area with poor internet connectivity or if their device is not working properly.

- Fees: Some banks or financial institutions may charge fees for using Samsung Pay or for adding cards to the app, which could be a disadvantage for some users.

- Security Risks: While Samsung Pay is generally considered to be secure, there is always a risk of fraud or identity theft when making mobile payments. Additionally, users may be at risk if they lose their smartphone or if their device is stolen.

Samsung Pay’s disadvantages may include limited availability, device compatibility issues, reliance on technology, fees, and potential security risks. However, many users find that the advantages of Samsung Pay outweigh these potential drawbacks.

FAQ

How Is popular Samsung Pay?

Samsung Pay is a popular mobile payment service that has gained a significant user base since its launch in 2015. According to Samsung’s 2021 Q4 earnings report, Samsung Pay has over 15 million monthly active users globally.

The popularity of Samsung Pay can be attributed to its convenience, security, and compatibility with a wide range of payment terminals. Samsung Pay’s unique MST technology allows it to be used at payment terminals that do not support NFC, which can make it a more versatile payment option for users.

In addition, Samsung Pay offers various rewards programs, discounts, and promotions to incentivize users to use the service. This has helped to attract and retain users, as many consumers are looking for ways to save money or earn rewards while making purchases.

Samsung Pay’s popularity can be attributed to its user-friendly interface, advanced security measures, and compatibility with a wide range of payment terminals. As mobile payments continue to grow in popularity, Samsung Pay is expected to continue to be a popular payment option for users around the world.

How accessible and easy Samsung Pay is?

Samsung Pay is designed to be a convenient and accessible payment option for users. Here are some ways in which Samsung Pay is accessible and easy to use:

- User-friendly interface: The Samsung Pay app has a simple and user-friendly interface that makes it easy for users to add cards, make payments, and access rewards.

- Compatible with multiple devices: Samsung Pay is available on a wide range of Samsung devices, including smartphones, tablets, and smartwatches, making it easy for users to access the service.

- Compatible with a wide range of payment terminals: Samsung Pay uses both NFC and MST technology, allowing it to be used at most payment terminals, including those that do not support NFC.

- Easy to add and manage cards: Samsung Pay allows users to add and manage multiple cards within the app, making it easy to switch between cards for different transactions.

- Secure authentication methods: Samsung Pay uses advanced security measures, such as fingerprint and PIN verification, to ensure that only the authorized user can make payments.

- Convenient rewards programs: Samsung Pay offers various rewards programs, discounts, and promotions to incentivize users to use the service, making it a convenient and cost-effective payment option.

Samsung Pay’s accessibility and ease of use make it a popular choice among consumers who are looking for a convenient and secure mobile payment solution.

When is it better not to use Samsung Pay?

While Samsung Pay is a convenient and secure payment option for many users, there may be some situations where it may be better not to use the service. Here are some examples:

- Low battery or device issues: Samsung Pay requires a working smartphone with an active internet connection and NFC or MST technology to make payments. If your device is low on battery or experiencing technical issues, it may not be able to process payments properly.

- Poor internet connectivity: Samsung Pay requires an active internet connection to function properly. If you are in an area with poor internet connectivity, you may not be able to use Samsung Pay to make payments.

- Suspicious or unfamiliar merchants: While Samsung Pay is generally considered to be secure, there is always a risk of fraud or identity theft when making mobile payments. If you are using Samsung Pay at an unfamiliar or suspicious merchant, it may be better to use a different payment method to avoid potential security risks.

- Unsupported payment terminals: While Samsung Pay is compatible with a wide range of payment terminals, there may be some terminals that do not support the service. In these cases, you may need to use a different payment method, such as a physical credit card or cash.

- Fees and charges: Some banks or financial institutions may charge fees for using Samsung Pay or for adding cards to the app. If you are concerned about these fees, it may be better to use a different payment method.

While Samsung Pay is a convenient and secure payment option for many users, it may not always be the best choice depending on the situation. It is important to consider your device’s battery and connectivity, the merchant you are using, and any potential fees or charges before deciding whether to use Samsung Pay.

Related Video: How To FIX Samsung Pay Not Working!

Final Thoughts

Samsung Pay has made routine tasks easier by providing a convenient and secure mobile payment solution for users. With its user-friendly interface, advanced security measures, and compatibility with a wide range of payment terminals, Samsung Pay has become a popular payment option for consumers worldwide. The service allows users to easily add and manage cards, make payments quickly and efficiently, and access various rewards programs and promotions. By eliminating the need for physical credit cards or cash, Samsung Pay has streamlined the payment process, making routine tasks such as grocery shopping, dining out, or paying bills more convenient and hassle-free. Samsung Pay has helped to simplify everyday transactions and make routine tasks easier for users, contributing to a more efficient and streamlined daily life.