In recent years, mobile payment systems have become increasingly popular as a convenient way to pay for goods and services. Apple Pay (AP) is one of the most widely used mobile payment platforms, allowing users to pay for purchases with just a few taps on their gadget or Apple Watch (AW). While AP offers many benefits, such as enhanced security and ease of use, there may be times when you need to turn it off. Perhaps you are switching to a new device or simply want to disable the feature temporarily. In this article, we will provide you with a step-by-step guide on how to turn off AP, ensuring that your payment information stays secure and your AP account remains under your control.

So, How to Turn off Apple Pay?

If you need to turn off AP, perhaps because you have lost your gadget or AW, or you simply want to disable the feature temporarily, here are the steps you need to follow:

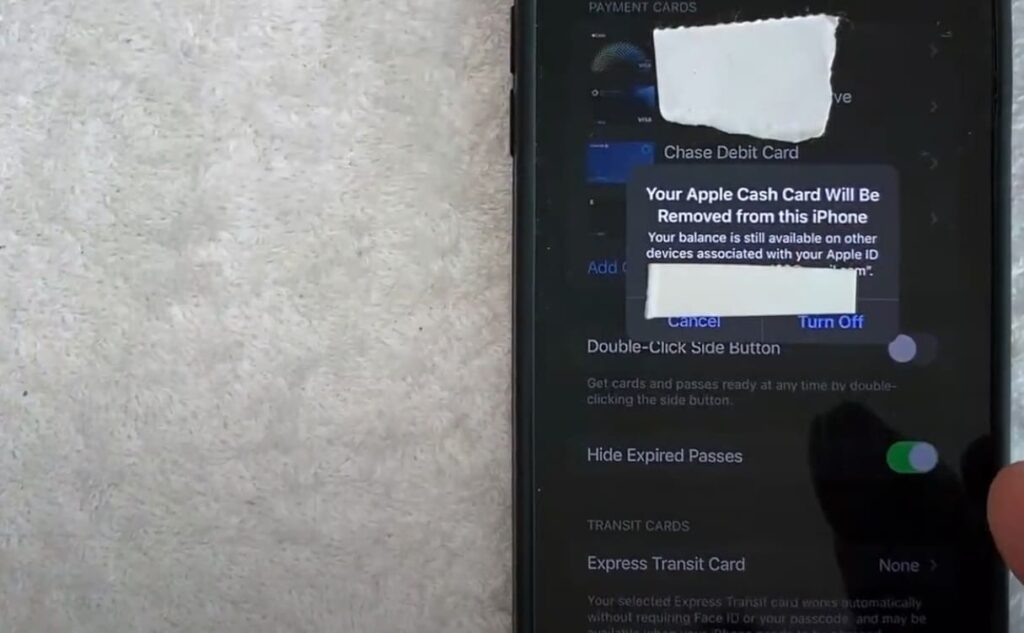

- On your gadget, go to Settings and scroll down to find Wallet & AP.

- Tap on Wallet & AP to open the settings.

- To turn off AP, simply toggle the switch next to “Allow Payments on iPhone” to the off position.

- If you have an AW, you will also need to turn off AP on your watch. To do this, open the AW app on your gadget and go to the My Watch tab.

- Tap on Wallet & AP, then toggle the switch next to “Allow Payments on AW” to the off position.

- Once you have turned off AP, you will no longer be able to use it to make payments on your gadget or AW. However, your payment information will still be stored in your Wallet app, so you can easily turn it back on when you are ready to start using AP again.

- If you have lost your gadget or AW and want to ensure that your payment information is secure, you should also consider using the “Erase All Content and Settings” feature on your device, which will wipe all of your data from the device and prevent anyone from accessing your AP account.

How To Turn On Apple Pay?

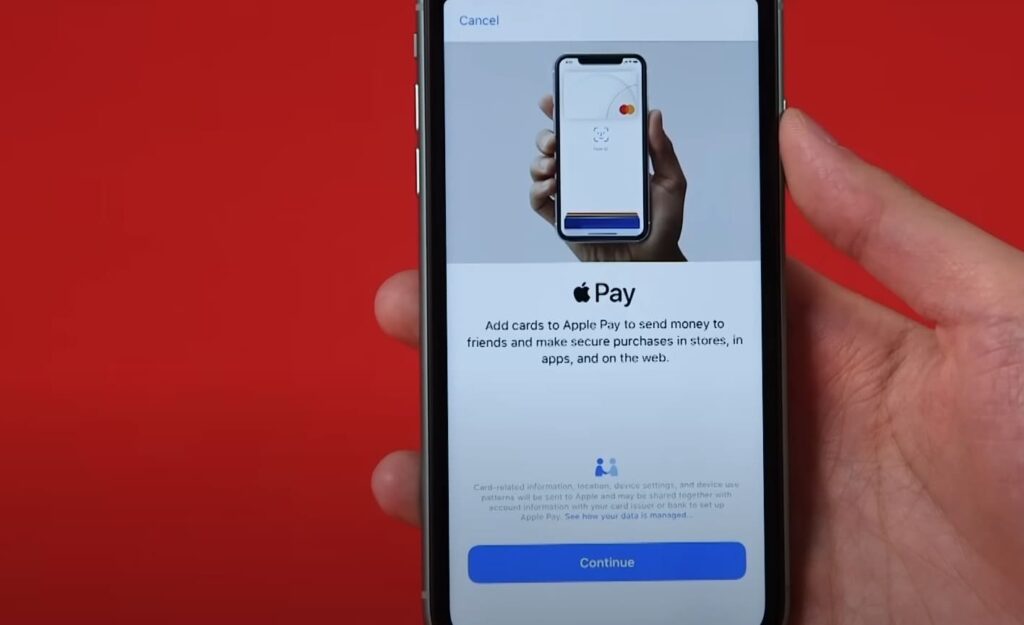

If you have previously turned off AP and want to turn it back on, or if you are setting up AP for the first time, here are the steps you need to follow:

- On your gadget, go to Settings and scroll down to find Wallet & AP.

- Tap on Wallet & AP to open the settings.

- To turn on AP, simply toggle the switch next to “Allow Payments on gadget” to the on position.

- If you want to add a new credit or debit card to your AP account, tap on “Add Credit or Debit Card” and follow the prompts to enter your card information.

- If you have an AW, you can also set up AP on your watch. Open the AW app on your gadget and go to the My Watch tab.

- Tap on Wallet & AP, then follow the prompts to add a new card or use an existing card from your gadget.

- Once you have turned on AP and added your payment information, you can start using it to make payments at participating retailers and websites. Simply hold your gadget or AW near the payment terminal or use the one-touch payment option on your MacBook Pro with Touch ID.

It’s important to note that when you turn on AP, your payment information is encrypted and stored securely on your device, so you can use it to make purchases without sharing your card details with retailers or websites.

For What It Needed To Turn Off Apple Pay?

There may be several reasons why someone may want to turn off AP. Here are some of the common reasons:

- Lost or Stolen Device: If you lose your gadget, iPad, or AW, or if it gets stolen, you may want to turn off AP to prevent anyone from using your cards without your authorization.

- Selling or Giving Away Device: If you’re selling or giving away your device, it’s important to turn off AP to ensure that the new owner doesn’t have access to your cards.

- Security Concerns: If you’re concerned about the security of your cards, you may want to turn off AW. While AP is generally considered secure, there’s always a risk of unauthorized access or fraud.

- Changing Banks or Cards: If you switch banks or get a new credit card, you’ll need to update your payment information in AP. In some cases, you may want to turn off AP temporarily until you’ve updated your payment information.

- Personal Preference: Finally, some people may simply prefer not to use AP for personal reasons or may want to switch to a different mobile payment method. In this case, turning off AP is a matter of personal preference.

For What Reasons It Needed To Turn On Apple Pay?

There are several reasons why you may want to turn on AP:

- Convenience: AP offers a fast, easy, and secure way to make payments without the need to carry physical cards or cash. You can use AP to make purchases online or in stores that accept contactless payments.

- Security: AP uses advanced security features such as tokenization, biometric authentication, and device-specific numbers to protect your payment information. This can help reduce the risk of fraud or unauthorized access.

- Compatibility: AP is widely accepted by merchants around the world, making it a convenient payment option when you’re traveling or shopping at a variety of retailers.

- Rewards and Cashback: Many banks and credit card issuers offer rewards and cashback for using AP to make purchases. This can help you save money or earn points that you can redeem for various benefits.

- Contactless Payments: In the wake of the COVID-19 pandemic, many people prefer contactless payments as a safer way to make purchases without coming into contact with high-touch surfaces. AP offers a convenient and secure contactless payment option that can help reduce the spread of germs.

What Is Apple Pay?

AP is a digital wallet and mobile payment service developed by Apple Inc. It allows users to store their credit, debit, and prepaid cards in the Wallet app on their gadget, iPad, or AW, and make payments securely and easily using their device. AP is compatible with a variety of payment terminals, allowing users to make purchases in stores, online, and within apps.

To use AP, users simply need to add their payment cards to their Wallet app by either taking a photo of the card or manually entering the details. Once the card is added, it can be used to make payments at supported merchants by holding the gadget, iPad, or AW close to the contactless payment terminal and using Touch ID, Face ID, or the device’s passcode to authenticate the transaction.

AP uses advanced security features such as tokenization, biometric authentication, and device-specific numbers to protect the user’s payment information. This makes it a secure and convenient way to make payments without the need to carry physical cards or cash.

What Is The Main Goal Of Apple Pay?

The main goal of AP is to provide a convenient, secure, and easy-to-use mobile payment system for users. AP aims to simplify the payment process by allowing users to make purchases using their gadget, iPad, or AW, without the need to carry a physical wallet or card.

In addition to convenience, AP also prioritizes security. By using advanced security features such as tokenization, biometric authentication, and device-specific numbers, AP aims to protect users’ payment information and reduce the risk of fraud or unauthorized access.

AP also aims to be widely accepted by merchants around the world, making it a convenient payment option when traveling or shopping at a variety of retailers. By offering a secure, convenient, and widely accepted payment option,AP aims to improve the overall payment experience for users and make mobile payments a more mainstream and accessible option.

What Goals For The Future Has Apple Pay?

While AP has already achieved significant success as a mobile payment system, the company has several goals for the future of the service. Some of these goals include:

- Increasing Adoption: AP aims to continue to expand its user base and increase adoption among merchants. This could involve partnering with more banks and financial institutions to make it easier for users to add their payment cards, as well as working with more merchants to support AP at their locations.

- Expanding Features: AP aims to continue to add new features and functionality to the service. This could include new payment options such as person-to-person payments or the ability to pay bills using AP, as well as integrating with other Apple services such as Apple Wallet or AW.

- Integration with Other Countries: AP has already expanded to many countries around the world, but the company aims to continue to integrate with more countries and regions. This could involve working with more international banks and merchants, as well as adapting the service to meet local regulations and requirements.

- Emphasizing Contactless Payments: AP aims to continue to promote contactless payments as a safer and more convenient way to make purchases, especially in light of the COVID-19 pandemic. The company may work with more merchants to encourage the adoption of contactless payment options and promote the benefits of mobile payments.

AP aims to continue to be a leading mobile payment service by offering a convenient, secure, and easy-to-use payment option for users around the world.

What Alternatives I Can Use For Apple Pay?

If you’re looking for alternatives to AP, there are several other mobile payment services available. Here are a few popular options:

- Google Pay: Google Pay is a mobile payment service similar to AP that allows users to store their payment cards and make purchases using their smartphone. It is compatible with both Android and iOS devices and is accepted at many merchants around the world.

- Samsung Pay: Samsung Pay is a mobile payment service developed by Samsung that allows users to make purchases using their Samsung smartphone or smartwatch. It is compatible with select Samsung devices and is accepted at many merchants that accept contactless payments.

- PayPal: PayPal is a popular payment platform that allows users to store their payment information and make purchases online or in-store using their smartphone or tablet. It is accepted at many merchants worldwide and can also be used to send and receive money between individuals.

- Venmo: Venmo is a payment app that allows users to send and receive money between individuals. It is often used for splitting bills, paying back friends, and other informal transactions.

- Square Cash: Square Cash is a payment app developed by Square that allows users to send and receive money between individuals or pay for goods and services at participating merchants. It is accepted at many merchants in the United States.

These are just a few examples of the many mobile payment services available. The best option for you will depend on your specific needs and the availability of the service in your area.

What Scandals Apple Pay Had?

As a mobile payment service, AP has not had many scandals or major issues. However, there have been a few incidents that have drawn attention in the media:

- Fraudulent Transactions: In 2019, it was reported that some users had experienced fraudulent transactions on their AP accounts. This was due to scammers obtaining the user’s login information and adding their own cards to the user’s account, which they then used to make unauthorized purchases. Apple responded by encouraging users to enable two-factor authentication and to use strong, unique passwords to protect their accounts.

- Antitrust Investigation: In 2020, the European Union launched an antitrust investigation into AP over concerns that the company may be using its market power to limit competition. The investigation is ongoing and could potentially result in fines or other penalties for Apple.

- Accessibility Lawsuit: In 2021, a blind user filed a lawsuit against Apple, alleging that the company’s AP system is not accessible to blind and visually impaired users. The lawsuit argues that Apple Pay violates the Americans with Disabilities Act by not providing a way for blind users to independently verify their transactions.

While AP has not had many scandals or major issues, the service is not immune to criticism or legal challenges. Like any payment system, it is important for users to remain vigilant and take steps to protect their accounts and personal information.

Advantages Of Turning Off Apple Pay

While there may be situations where turning off AP is necessary, there are not many advantages to doing so. In fact, turning off AP may actually limit your payment options and make it more difficult to make purchases in certain situations.

Here are a few situations where turning off AP could be advantageous:

- Security Concerns: If you suspect that your AP account has been compromised or you have lost your device, turning off AP can help protect your account and prevent unauthorized transactions.

- Changing Payment Methods: If you no longer want to use AP as your primary payment method, you may choose to turn it off and switch to a different payment option.

- Privacy Concerns: If you have concerns about the privacy of your payment information or prefer not to share your payment data with Apple, turning off AP may be a viable option.

However, it’s important to note that turning off AP may limit your payment options and may not be a practical choice for everyone. AP offers a convenient and secure way to make payments, and turning it off may require you to carry physical payment cards or rely on alternative payment methods that may be less convenient or secure.

Disadvantages Of Turning Off Apple Pay

There are several disadvantages to turning off AP. Here are a few examples:

- Limited Payment Options: Turning off AP limits your payment options, as you won’t be able to use your mobile device to make purchases at merchants that accept AP. You’ll need to carry physical payment cards, which can be inconvenient and less secure than using AP.

- Reduced Security: AP offers enhanced security features that protect your payment information, such as tokenization and biometric authentication. If you turn off AP, you may be exposing your payment data to a greater risk of theft or fraud.

- Less Convenience: AP offers a quick and easy way to make payments without having to pull out your physical payment card. If you turn off AP, you may need to carry multiple cards or rely on alternative payment methods that may be less convenient.

- Missed Rewards: Some credit cards offer rewards for using mobile payments like AP. If you turn off AP, you may miss out on these rewards.

Turning off AP may not be the best option for most people. While there may be some situations where turning it off is necessary, the advantages of using AP generally outweigh the disadvantages.

FAQ

How Is It Easy To Use Apple Pay?

AP is designed to be a simple and easy-to-use mobile payment system. Here’s how to use it:

- Set up Apple Pay: Open the Wallet app on your gadget, tap the plus sign (+) in the upper-right corner, and follow the prompts to add your credit or debit card to AP. You can also add cards by going to Settings > Wallet & AP.

- Make a Payment: When you’re ready to make a payment, hold your gadget near the contactless reader at the merchant. Your gadget will automatically recognize that you’re trying to pay with AP, and your default card will appear on the screen.

- Authenticate the Payment: To authenticate the payment, use Touch ID or Face ID, depending on which gadget model you have. If you’re using an AW, double-click the side button to activate AP and hold it near the contactless reader.

- Wait for Confirmation: Once your payment is accepted, you’ll see a confirmation on your device and hear a beep or vibration, depending on your settings.

That’s it! Using AP is as simple as holding your device near the contactless reader and authenticating the payment with Touch ID or Face ID. You can also use AP to make purchases online or in apps that accept it as a payment option.

What Apple Pay Features Should I Know?

Here are some important features of AP that you should know:

- Security: AP uses several security measures to protect your payment information, including tokenization, Touch ID or Face ID authentication, and device-specific security features. Your payment card details are never stored on your device or shared with merchants.

- Supported Devices: AP is available on gadgets, iPads, Macs, and Apple Watches. Your device must have Touch ID, Face ID, or a passcode set up for authentication.

- Compatibility: AP is accepted at millions of merchants worldwide, including retailers, restaurants, and transportation providers. Look for the contactless payment symbol or Apple Pay logo to see if a merchant accepts Apple Pay.

- Rewards: Many credit card issuers offer rewards for using Apple Pay to make purchases, such as cashback, points, or miles. Check with your card issuer to see if you’re eligible for rewards.

- Online and In-App Purchases: You can use AP to make purchases online and in apps that accept it as a payment option. Just select AP at checkout and authenticate the payment with Touch ID, Face ID, or your device passcode.

- Peer-to-Peer Payments: You can also use AP to send and receive money with friends and family through the Messages app. Just select the Apple Pay button in a conversation and enter the amount you want to send or request.

AP is a convenient and secure payment option that offers a range of features to make your transactions quick and easy.

How To Use Apple Pay?

Here’s how to use AP:

- Add Your Cards: To start using AP, you’ll need to add your credit or debit cards to the Wallet app on your iPhone. Open the Wallet app and tap the “+” button in the upper-right corner to add a card. You can also add a card by going to Settings > Wallet & Apple Pay.

- Make a Payment: When you’re ready to make a payment, hold your iPhone near the contactless reader at the merchant. Your iPhone will automatically recognize that you’re trying to pay with Apple Pay, and your default card will appear on the screen.

- Authenticate the Payment: To authenticate the payment, use Touch ID or Face ID, depending on which iPhone model you have. If you’re using an Apple Watch, double-click the side button to activate Apple Pay and hold it near the contactless reader.

- Wait for Confirmation: Once your payment is accepted, you’ll see a confirmation on your device and hear a beep or vibration, depending on your settings.

You can also use Apple Pay to make purchases online or in apps that accept it as a payment option. Just select Apple Pay at checkout and authenticate the payment with Touch ID or Face ID. You can also use Apple Pay to send and receive money with friends and family through the Messages app.

Note that not all merchants accept Apple Pay, so be sure to look for the contactless payment symbol or Apple Pay logo to see if a merchant accepts it. Also, be sure to keep your device and passcode secure to prevent unauthorized access to your payment information.

Related Video: How To Turn Off Apple Pay Cash On iPhone

Final Words

In conclusion, AP is a convenient and secure mobile payment system that allows you to make purchases with your iPhone, iPad, Mac, or AW. However, if you need to turn off AP for any reason, you can easily do so by following the steps outlined in this article.

Keep in mind that turning off AP will prevent you from using it for any transactions, so make sure you have an alternative payment method available if you need to make purchases. If you decide to turn Apple Pay back on, you can do so at any time by following the same steps in reverse.

Whether you choose to use AP or not, it’s important to keep your payment information and personal devices secure to protect yourself from fraud and identity theft.